Finance Transformation and the Business Case for Accounting View of Logistics

Authored by: Matt Montes, Senior Consultant, TruQua

How does Finance Transformation drive Enterprise-Wide Reporting?

In the everchanging landscape of IT and financial software, SAP continues to innovate and drive finance transformation with powerful products like S/4HANA, SAP Analytics Cloud, Group Reporting, and SAP HANA. These examples are just a few pieces of the larger enterprise architecture puzzle and each piece involves or drives a different component of reporting strategy:

- SAP S/4HANA –> Finance and Logistics

- SAP Analytics Cloud –> History, Plan, Forecast and Predictive Analytics

- Group Reporting –> Consolidated Financials

- SAP HANA –> Information Models

At its core, a Finance Transformation is a large-scale process change in which business processes and reporting are redesigned through a series of strategical initiatives and technological implementations (this is where the pieces of the puzzle start to slowly come together).

SAP S/4HANA is the key enabling technology for any finance transformation centered around enterprise management processes. Also, much like any ERP, there are multiple paths to adoption, each of which has its own pros and cons.

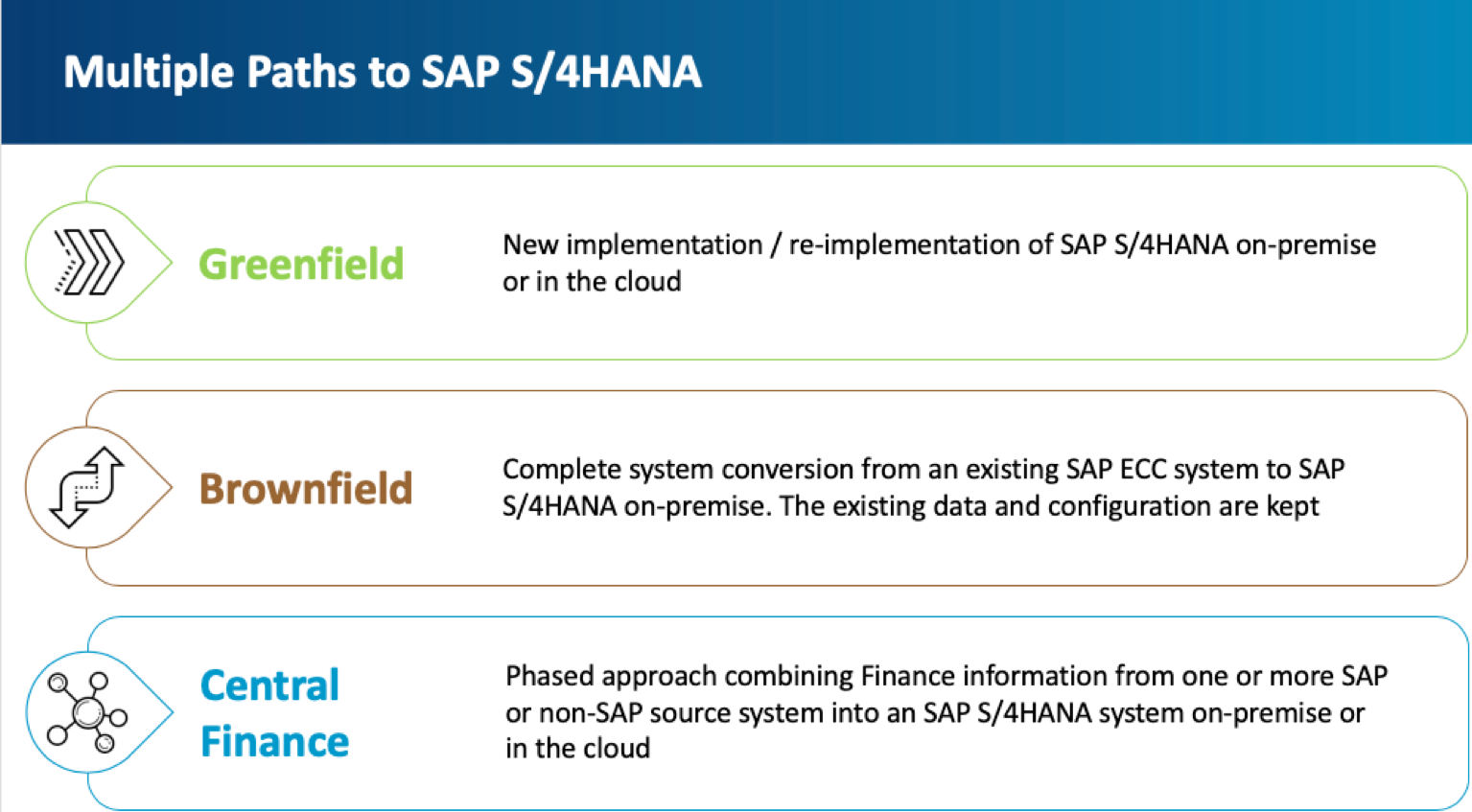

The paths to S/4HANA generally revolve around three approaches: Greenfield, Brownfield, and Central Finance (Figure 1 below).

Figure 1: Multiple Paths to SAP S/4HANA

The traditional Greenfield path eliminates any constraints imposed by previous work; it requires a complete build from the ground up or use of SAP Best Practice pre-delivered content. In contrast, the Brownfield path allows for a modification/upgrade of what currently exists, but the option is limited when it comes to process redesign. As an alternative, SAP offers “Central Finance”, which is both a product and a deployment approach to S/4HANA that combines the flexibility of Greenfield and the non-disruption of Brownfield. Through the Central Finance path to S/4HANA, the customer can take financial (FI) and management (CO) accounting data from SAP and non-SAP systems and combine them into one “central” S/4HANA system while harmonizing their master data and financial processes.

Whether a customer chooses to adopt a Greenfield, Brownfield, or Central Finance approach, one constant piece to the puzzle will always be enterprise-wide reporting. Unlike Greenfield or Brownfield, Central Finance is primarily focused on financial and management data. So, what happens to the logistical data associated with sales and procurement? More specifically, what about the ability to link logistical data to financial documents such as Customer/Supplier invoices or Sales/Purchase orders?

Accounting View of Logistics (AVL) comes into play for these scenarios. AVL can be deployed in conjunction with Central Finance to provide more holistic data and reporting that spans the domains of finance, management, and logistics. Now that we have an introductory baseline, let’s discuss AVL integration with Central Finance by focusing on the following topics:

- What is AVL?

- How does AVL work?

- What are the benefits, use cases, and reporting scenarios associated with AVL?

What is AVL?

Accounting View of Logistics (AVL) is Central Finance-specific functionality in which logistical information is loaded and replicated from SAP source systems into Central Finance and stored in a series of shadow tables. (1) Furthermore, the implementation of AVL comes with a low barrier to entry as it leverages the technical framework that’s already in place for Central Finance; in other words, SAP Landscape Transformation (SLT) and Application Interface Framework (AIF).

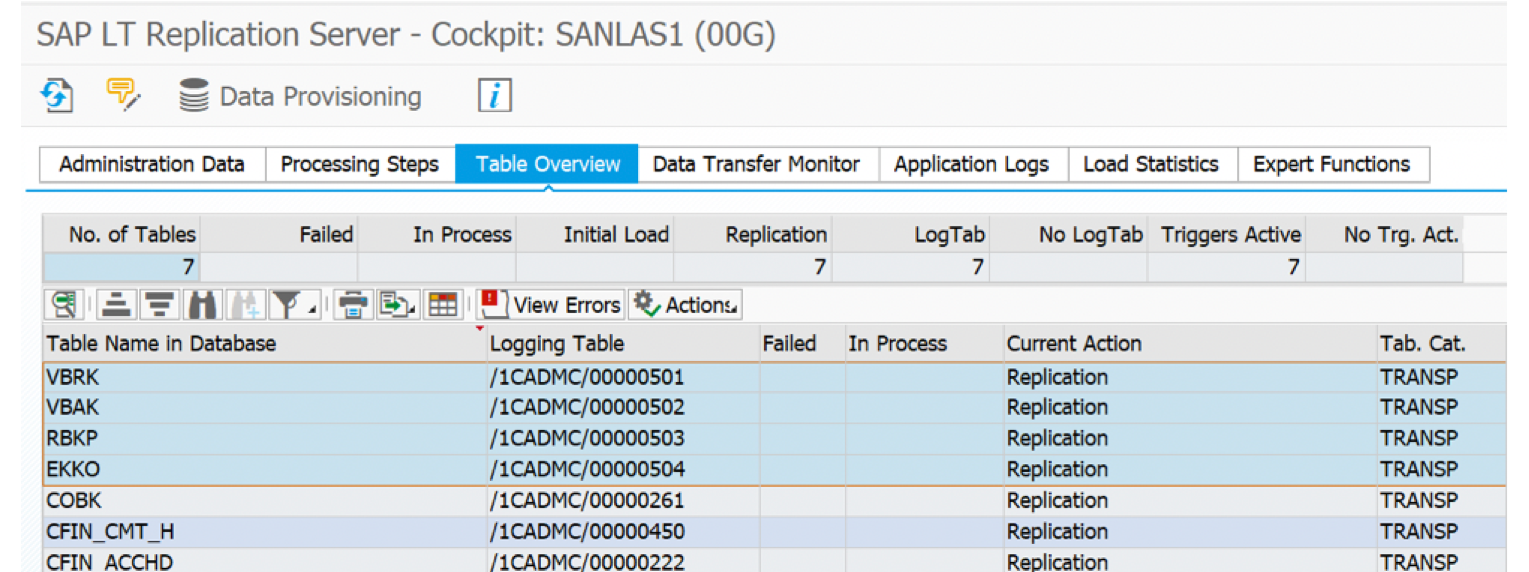

Figure 2: SAP Landscape Transformation (SLT)

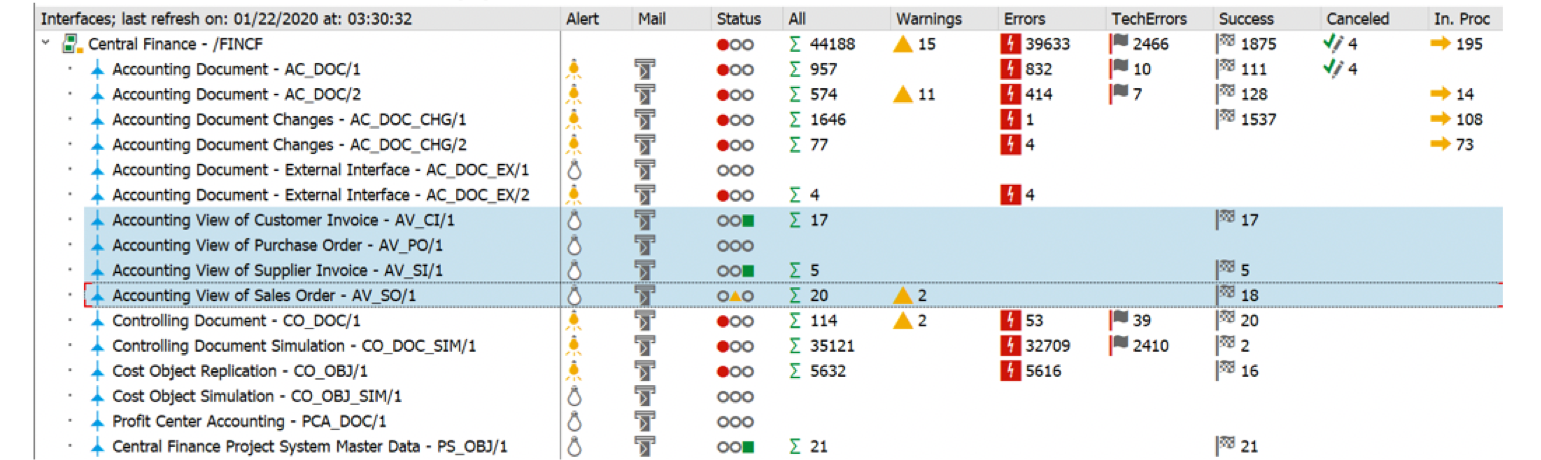

Figure 3: Application Interface Framework (AIF)

As one can see from the SLT (Figure 2) and AIF (Figure 3) screenshots above, the scope of the logistical data includes Sales Orders, Customer Invoices, Purchase Orders, and Supplier Invoices. Essentially, with the SLT and AIF framework already in place for Central Finance, AVL can be easily integrated through a series of notes, programs, and table loads.

How does AVL work?

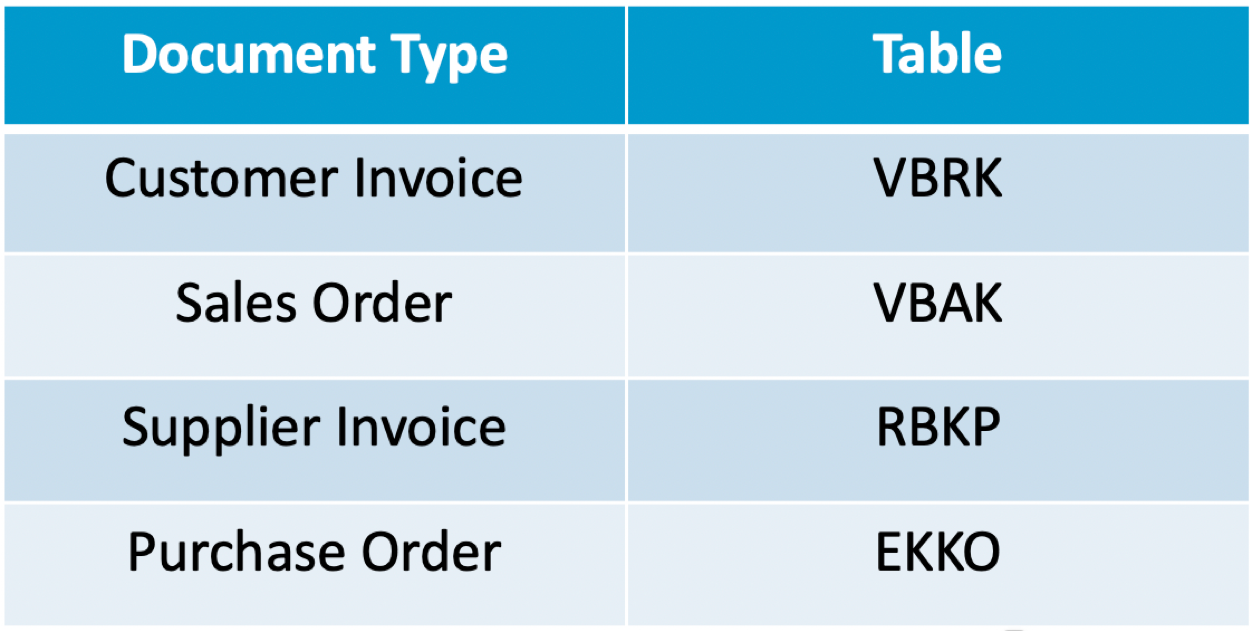

AVL loads and replicates logistical data into Central Finance through SAP Landscape Transformation at the Header, Line Item, Pricing, and Partner Information level. This is achieved through the following source system logistics tables:

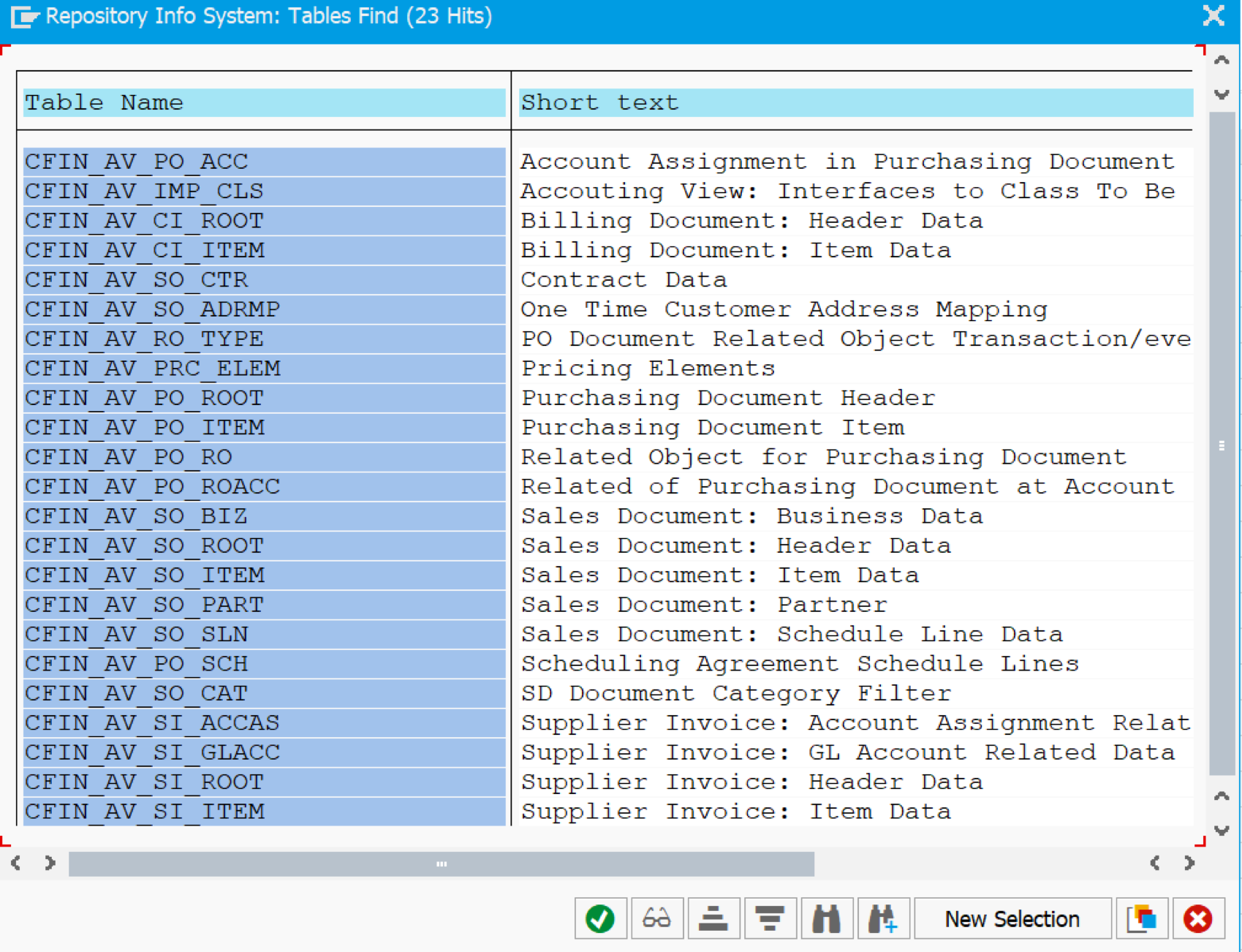

Figure 4: Source System Logistical Tables

Figure 5: Central Finance AVL Tables

The logistical data from the source system tables (Figure 4) are brought into the Central Finance system and are accessible for data analysis and reporting through a series of “CFIN_AV” tables (Figure 5).

The value proposition of AVL lies in the fact that data from various logistical tables can be brought into Central Finance without the need to configure and integrate the Logistics modules (i.e. SD and MM) in S/4HANA, as pictured in Figures 4 and 5. Additionally, since the AVL data is brought through SLT and posted to the AIF, Central Finance’s internal mapping framework (known as MDG Foundation) can be leveraged. This means that logistically relevant master data (Plants, Profit Centers, Customers, Vendors, Tax Codes) can also be mapped to abide by any prospective design changes that are set to take place as part of the Central Finance implementation.

What are the benefits, use cases and reporting scenarios associated with AVL?

Now that the what and how of AVL has been discussed, what value can it truly add when coupled with a Central Finance implementation? First and foremost, AVL provides logistical insight in Central Finance without the need for extensive configuration and master data, customization of data, or custom programs and tables. Simply put, AVL helps to bridge the data gap between Finance and Logistics without the need for a custom approach or extensive configuration. Additionally, AVL also enables more detailed profitability analysis through the inclusion of partner functions such as Ship-to, Sold-to, and Bill-to. Lastly, AVL facilitates Central Finance’s ability to link financial documents to their associated Purchase Orders, Sales Orders, Supplier Invoices, and Customer Invoices.

As alluded to above, the inclusion of logistical data into a Central Finance environment introduces a new level of integrated Financial and Logistical reporting. As a result, some of SAP’s directional use cases and roadmap ideas can be leveraged to help further illustrate the concept of AVL:

- Reporting integration across SD, MM, FI and CO data sets

- Revenue Accounting

- Central Purchase Order Accrual

- Advanced Compliance Reporting (ACR for Tax Reporting)

- Basis on which predictive accounting can be achieved via Central Finance

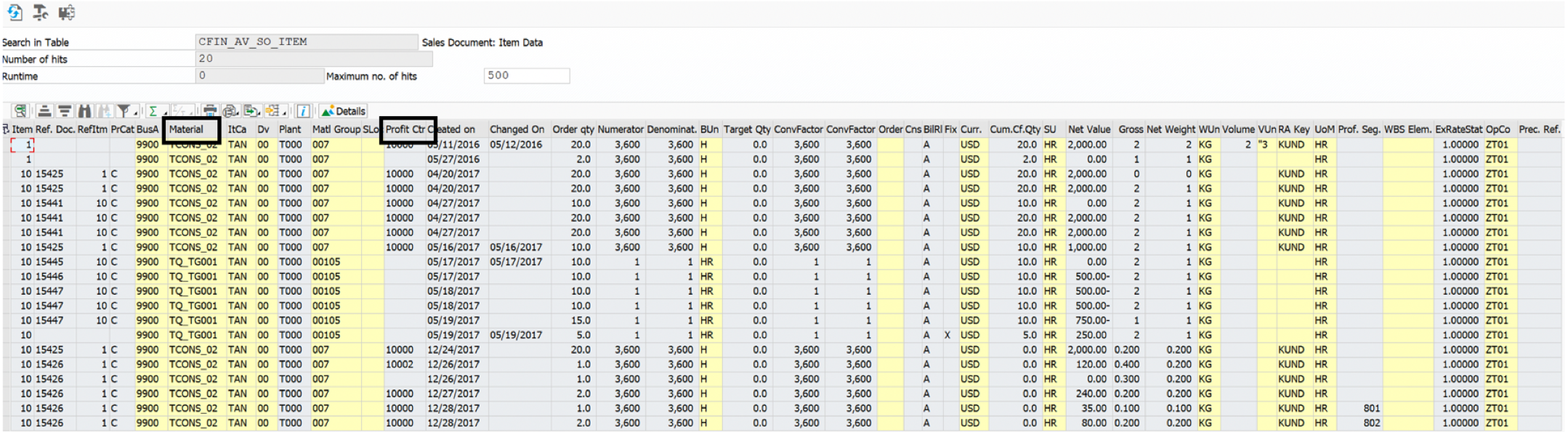

Figure 6: Sales Document Line Items Table in Central Finance

Through each one of these use cases, AVL introduces a new level of reporting detail previously unavailable in a standard Central Finance scenario. Leveraging the data from business partner functions can provide additional insight into sales, customers and the overall order to cash process. Ultimately, the ability to perform Revenue Accounting via additional Sales and Distribution data is supported by AVL.

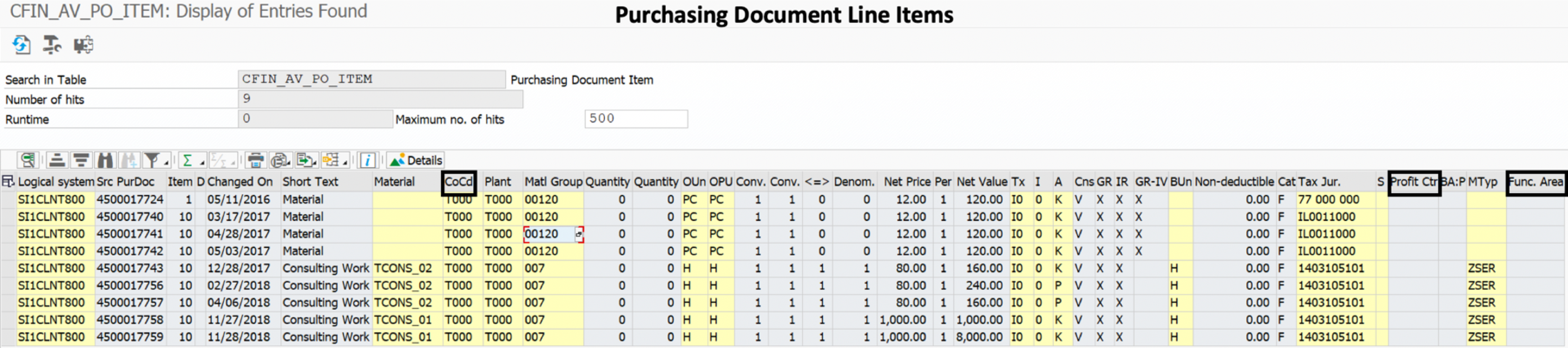

Figure 7: Purchasing Document Line Items Table in Central Finance

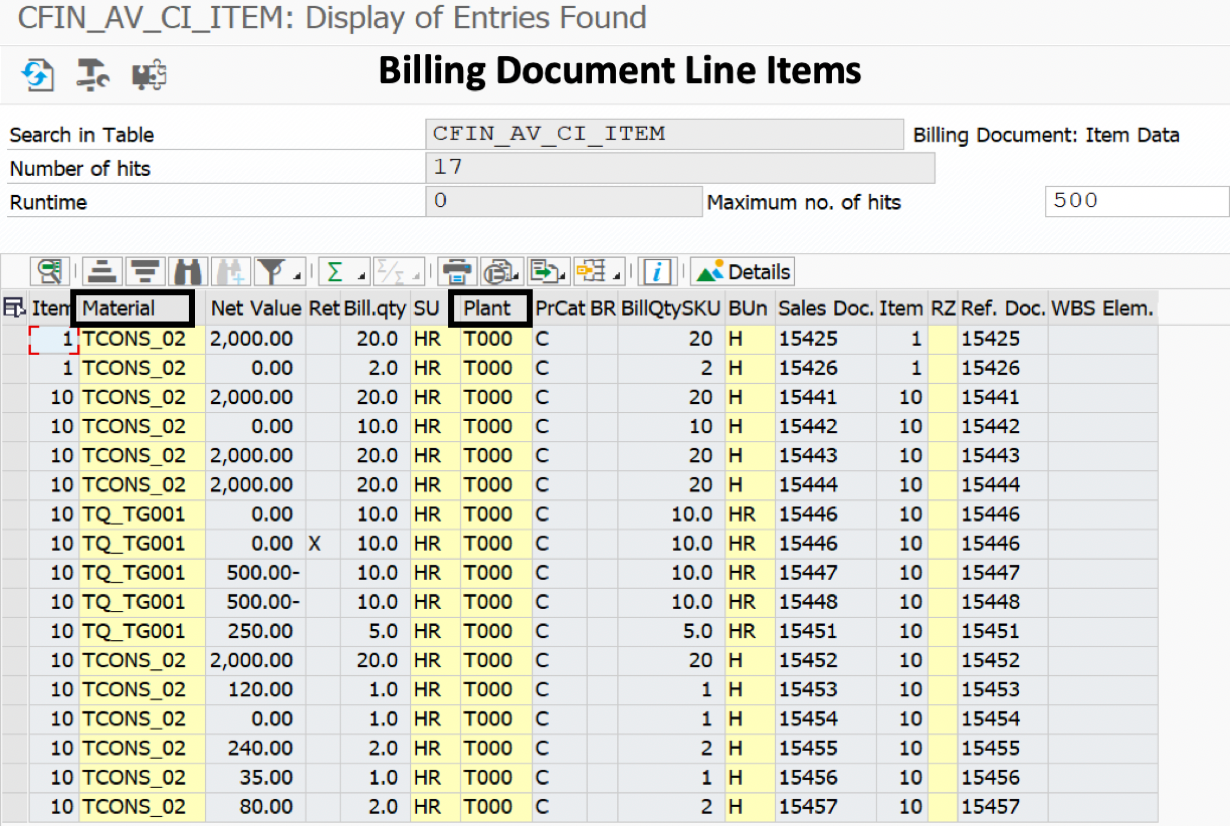

Figure 8: Billing Document Line Items Table in Central Finance

With the inclusion of purchasing, billing and material data within AVL, SAP customers can create Purchase Order Accruals directly in the Central Finance system. Furthermore, companies can start to drive a more holistic coverage of their enterprise-wide reporting via Central Finance by integrating SD, MM and FI data that is also in support of Advanced Compliance Reporting for Tax Reporting.(2)

Conclusion

As customers start their finance transformation journeys, they are faced with three potential paths to adopting S/4HANA: Greenfield, Brownfield, and Central Finance. With enterprise-wide reporting being a common requirement throughout all three options, customers must consider what the optimal adoption path and reporting strategy should be.

For those customers embarking on a Central Finance implementation, the Accounting View of Logistics is a simple and straight forward framework that can enhance and drive reporting strategy. Through the technical framework of SLT and AIF, logistical data is replicated into Central Finance and posted to a series of shadow tables, which can ultimately be leveraged as a way to integrate Financial and Logistical data for enterprise-wide reporting. With Central Finance and AVL, enterprises can receive a more holistic picture of their data, resulting in more accurate and detailed reporting. AVL is by no means a permanent substitute for logistical data in Central Finance, but merely an intermediary approach until customers are able to migrate all of their business processes over to the Central Finance system.

About the Author

Matt Montes is a Finance and Data-driven professional currently working as an SAP Financials Senior Consultant. He received his education from the University of Texas at Austin with a degree in Finance and a minor in Accounting. His professional experience is comprised of financial analysis, budgeting, consolidation, accounting, and data analytics. Matt Montes has 4.5 years of financial consulting experience utilizing Central Finance, S/4HANA, ECC, Fiori, SAC, GR, and BPC. In addition to 3 full lifecycle implementations, product development, and 6 POC’s, Matt Montes also works as a trainer and content developer. Matt Montes has conducted three internal and external pieces of training covering Central Finance, Group Reporting, SAC, and Reporting & Analytics. Additionally, Matt Montes has written and delivered three blogs, three webinars, and a 3-part demo series on Central Finance.

Matt Montes is a Finance and Data-driven professional currently working as an SAP Financials Senior Consultant. He received his education from the University of Texas at Austin with a degree in Finance and a minor in Accounting. His professional experience is comprised of financial analysis, budgeting, consolidation, accounting, and data analytics. Matt Montes has 4.5 years of financial consulting experience utilizing Central Finance, S/4HANA, ECC, Fiori, SAC, GR, and BPC. In addition to 3 full lifecycle implementations, product development, and 6 POC’s, Matt Montes also works as a trainer and content developer. Matt Montes has conducted three internal and external pieces of training covering Central Finance, Group Reporting, SAC, and Reporting & Analytics. Additionally, Matt Montes has written and delivered three blogs, three webinars, and a 3-part demo series on Central Finance.

For more information on the functionality within AVL and Central Finance or an exploratory call on what an implementation would look like within your organization, contact us today at info@truqua.com or simply fill out our form below!

Works Cited

Accounting View of Logistics Help (1): https://help.sap.com/viewer/26c2d5e366bc44c1a98f2a9212a0c49d/1909.000/en-US/fb0dafb1f0fe48f1aa30543cdd2cf8f6.html

Advanced Compliance Reporting (2): https://help.sap.com/viewer/3cc1da1e1e364fadb9b1af653a9597d2/1709%20002/en-US