CFIN+ Blog Series: SAP Advanced Financial Closing and SAP S/4HANA Central Finance - A Smart and Autonomous Way to Close the Books

Introducing our CFIN+ blog series where TruQua experts cover topics relating to the future of finance transformation and best practices for driving value using the next generation of SAP finance solutions.

CFIN+ Blog Series

SAP Advanced Financial Closing (AFC) and SAP S/4HANA Central Finance:

A Smart and Autonomous Way to Close the Books

Authored by Taylor Luce, SAP Business Transformation Consultant, TruQua, an IBM Company, and Matt Montes, SAP Financials Senior Managing Consultant, TruQua, an IBM Company.

What if there was a way to remediate the office-wide stress that oftentimes accompanies the month-end closing processes? What if we told you that it is possible to start these processes earlier in the month with both predictive and real time month-end data? SAP Advanced Financial Closing (AFC) solution makes these “what-ifs” a reality.

AFC is a hub solution designed to orchestrate financial closing processes. AFC enables users to start their month-end closing processes earlier in the period by utilizing smarter and more autonomous practices. Together with SAP S/4HANA Central Finance and Predictive Accounting, financial data becomes increasingly transparent, datasets become unified, and closing the books becomes easier.

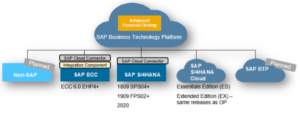

Figure 1: SAP BTP Architecture with AFC

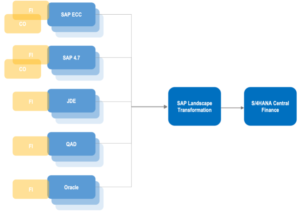

SAP S/4HANA Central Finance receives financial accounting transaction data through real-time replication from both SAP and non-SAP ERP source systems. This data is then consolidated into a company-wide “single source of truth” which is then used for financial reporting. With enterprise-wide financial data existing in one unified location, the ability to report on this data becomes simpler and the option to start closing the books earlier becomes much more feasible.

Figure 2: SAP Central Finance Architecture for SAP and Non-SAP Systems

How AFC Works

Entity-level financial closing is a tedious, high-stress, and complex task. Enterprises are oftentimes comprised of more than one shared service location or ERP system and face differing accounting regulations that create closing challenges. AFC places greater visibility into the eyes of the finance management team to proactively track the financial progress of the company to ensure a complete, accurate, and timely close process.

AFC is deployed in the cloud and available as a SaaS to be accessed from any web browser. AFC provides a closing template that helps financial teams document their tasks and procedures in a sequential timeline. SAP’s template includes best practice key closing tasks in addition to dependencies for the latest SAP S/4HANA release. Companies utilize this template as a baseline and will add and remove line items to create their company-specific closing checklist. Once finalized, the template stands as an enterprise-wide view of the closing process and includes the standard operating procedures, the responsible parties, approval requirements, and timing.

When a company decides that it is time to start the closing process, whether it be month end or year end, the template will generate a task list for each responsible party involved. Teams are not responsible for manually adjusting the task lists each month as this is automatically done by AFC. To auto adjust, the individual task lists use the relative key date and organizational hierarchy information to define specific parameters for each task. The Manage Closing Task Lists application is a flexible tool that allows multiple Task List Models to be assigned to the same folder level. This gives the user the option to create a Task List Model for every major process that is subject to a financial close such as Order-to-Cash, Procure-to-Pay, Record-to-Report, etc.

SAP Advanced Financial Closing accelerates the period-end close process by means of four strategies:

- The closing template creates standardization to be reused at the end of each month.

- There are a handful of closing steps that can be automated and scheduled to start in multiple ERP systems without manual interaction.

- Workflow notifications keep all team members up to date.

- Regardless of location, the closing schedule and status is visible to everyone.

All four of these strategies, in conjunction with S/4HANA and Central Finance, help modernize the month-end close process. Figure 3 below shows how Continuous Accounting can expedite the traditional month-end close process by engaging intercompany, currency, and consolidation processes earlier in the month.

Figure 3: Traditional vs. Continuous Close

In line with the concept of Continuous Accounting, SAP S/4HANA and Central Finance can continue to support and provide prediction, improve accuracy, and remove any surprises from the month end close with Predictive Accounting. Predictive Accounting is a solution that provides a future view of your company’s accounting results by automatically posting predictive journal entries and reversals in a dedicated ledger (extension ledger) that mimics the document flow of a standard business process. The generated journal entries not only follow the business document flow, but also reflect any changes made in the source document to allow for an accurate completeness and validation of all master data. Predictive Accounting places an increased ability in the Finance department to combine predictive postings and actual postings to produce real-time and forward-looking insights that support period end operational decisions.

Together with AFC, Predictive Accounting mitigates the following business challenges:

- Period end surprises become obsolete with the ability to predict the remaining results of all closing activities.

- Real-time and forward-looking insights become more achievable using Business Process Information as opposed to complex algorithms.

- With the ability to move tasks earlier in the period, closing to-do lists are cut in half making financial goals more achievable.

Real World Example:

At the 2022 SAP for Central Finance Conference Americas, a cross-industry manufacturer of confectionery, pet food, other food products, and a provider of animal care services gave a presentation on how they capitalized on AFC during their Central Finance implementation. They utilized AFC to automate and digitize processes to successfully implement Central Finance at scale. Post go-live, AFC better optimized their master data processes through means of resource savings and improved quality that were not initially picked up on in previous test cycles.

Using automation, they reassessed their deployment strategy in a handful of ways. Digital workers replaced manual labor to perform automated reconciliation and detect variances. The development of Business Objects Data Services (BODS) and bots led to journal automation and automatic file creation further lessening the need for human resources. The implementation of master data control checks reduced the volume of Application Interface Framework (AIF) errors post go-live. Machine learning administered the prerequisite master data cleansing tasks in the source systems. Lastly, enhancements to SAP Profitability and Performance Management (PaPM) and coding improved performance by automatically queuing company codes in the system.

New Capabilities with August 2022 AFC Release:

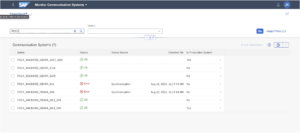

Integrating cloud based financial tools into your enterprises digital portfolio is critical to keep up with new enhancements, capabilities, and features. A new version of AFC was released in August of 2022. The recent release includes a new app to monitor communication systems and improvements to old apps such as managing closing tasks lists and processing closing tasks. AFC is ever-changing with SAP routinely releasing updates to the application.

The new app, Monitor Communication Systems, benefits system admins and technology teams, especially those with complex multi-ERP landscapes, as it increases transparency of all connected systems to help in identifying errors sooner. The app has functionalities that allow users to drill down into the connection and synchronization status of all ERP systems across the enterprise.

Figures 4 and 5: Monitor Communication Systems Dashboard

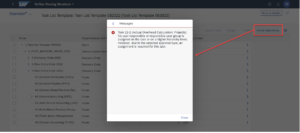

Improvements to the Manage Closing Tasks Lists app include a consistency check which will indicate whether a task list can be generated based on validations, the ability to add organizational units to an existing closing structure, the option to adjust dependent successor tasks, and it will now be possible to perform mass actions on closing types.

Figure 6: Defining Closing Structure

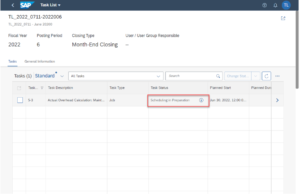

Enhancements to the Process Closing Tasks app include the ability to queue scheduled jobs that run autonomously in the background, a view into the task status sources, and users are now able to download spool lists for a further in-depth analysis.

Figure 7: Month-End Close Task List Creation

Conclusion

The SAP Advanced Financial Closing solution gives companies the power to capitalize on efficiency, accuracy, and speed in their financial closing processes. Through powerful automation, AFC enables companies to initiate their closing processes earlier in the period bringing them faster time to value, improved transparency, and a safeguarded close. Paired with Central Finance and Predictive Accounting, AFC revolutionizes the entity close allowing clients to experience complete control over their period-end activities.

About the Authors

Taylor Luce is a second year SAP Business Transformation Consultant with experience in the manufacturing and automotive industries. Taylor’s primary focus is collaborating with and guiding organizations undergoing Financial Transformation Initiatives with SAP S/4HANA and SAP Central Finance.

Matt Montes is a Finance and Data driven professional currently working as an SAP Financials Senior Managing Consultant for TruQua, an IBM Company. His professional experience is comprised of Finance Transformation engagements which includes accounting, business process design, financial planning & analysis, data analytics, training, and change management. Matt Montes has 7.5 years of financial consulting experience utilizing SAP Central Finance, SAP S/4HANA, SAP ERP, SAP Fiori, SAP Analytics Cloud, SAP Group Reporting, and SAP Business Planning and Consolidation. In addition to 5 full lifecycle implementations, product development, and 6 POC’s, Matt Montes also works as a trainer, content developer, and international speaker.

Sources

SAP S/4HANA Cloud for Advanced Financial Closing | Close Software

Configuration Steps for SAP S/4HANA Cloud for AFC

R2R Series Blog #5: Hard Close, Fast Close, Soft Close and Continuous Accounting

SAP S/4HANA Cloud for advanced financial closing: sneak preview into the August 2022 release