SAP S/4HANA: Enabling Cross-System Treasury with Central Finance

Enabling Cross-System Treasury with Central Finance

Authored by Julien Delvat, TruQua

SAP S/4HANA deployed as central finance is typically considered to be the best option for organizations looking to report across multiple SAP and non-SAP ERP systems in real-time and at the transaction level. However, the harmonized information model provided by central finance is also the perfect platform to enable treasury applications.

* Note: some of the applications mentioned above require additional licenses. Contact your SAP representative for more information.

Harmonizing the Information Model

Implementing S/4HANA as Central finance requires a lot of coordination to synchronize the source systems. Several aspects of the information model need to be evaluated and potentially updated:

- Controlling Area / Operating Concern / Segments

- Company Codes

- G/L Accounts / Cost Elements

- Customers / Vendors / Business Partners

- Profit Centers / Cost Centers / Activity Types

- Plants / Materials

- Fiscal Year Variant / Periods / Plan Versions

- Number Ranges

- Currencies / Units of Measures

- Hierarchies

- Custom Fields

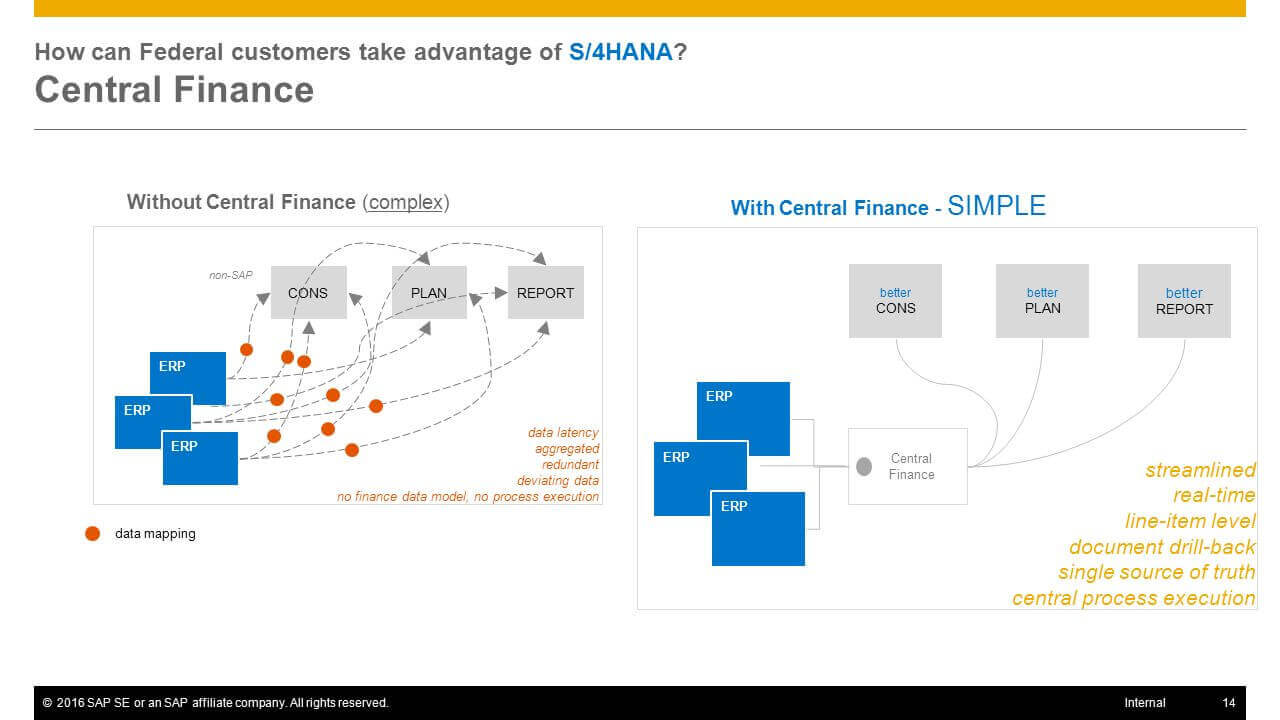

Simplified Landscape and Mapping with Central finance. Source: SAP

This preliminary work is crucial for the success of any central finance project, especially for reconciliation with the source systems and to create a unique reporting analysis across the organization. So why not leverage this harmonized data model to enable more scenarios such as treasury?

Cash and Liquidity Management

Once the data is harmonized across multiple systems through Central finance, Cash Managers will be able to deploy Cash and Liquidity Management applications.

Cash Flow Analyzer

Cash Flow Analyzer helps with the analysis of aggregate amounts and line item details of short-term cash position, medium and long-term liquidity forecast, and actual cash flows over time.

Video Source: https://support.sap.com/content/dam/productfeatures/assets/00014/6CAE8B28C5DB1ED792B92BBD67F600C2/demos/02_Demo_Cash_Flow_Analyzer.mp4

Promise to Pay Integration

Forecasted cash flows get updated in real time whenever unconfirmed invoices are updated in the source system or in the central finance system with a promised and paid amount and date.

Bank Communication

Communication with the bank and maintenance of bank information can be performed centrally with central finance.

Bank Account Balance Reconciliation

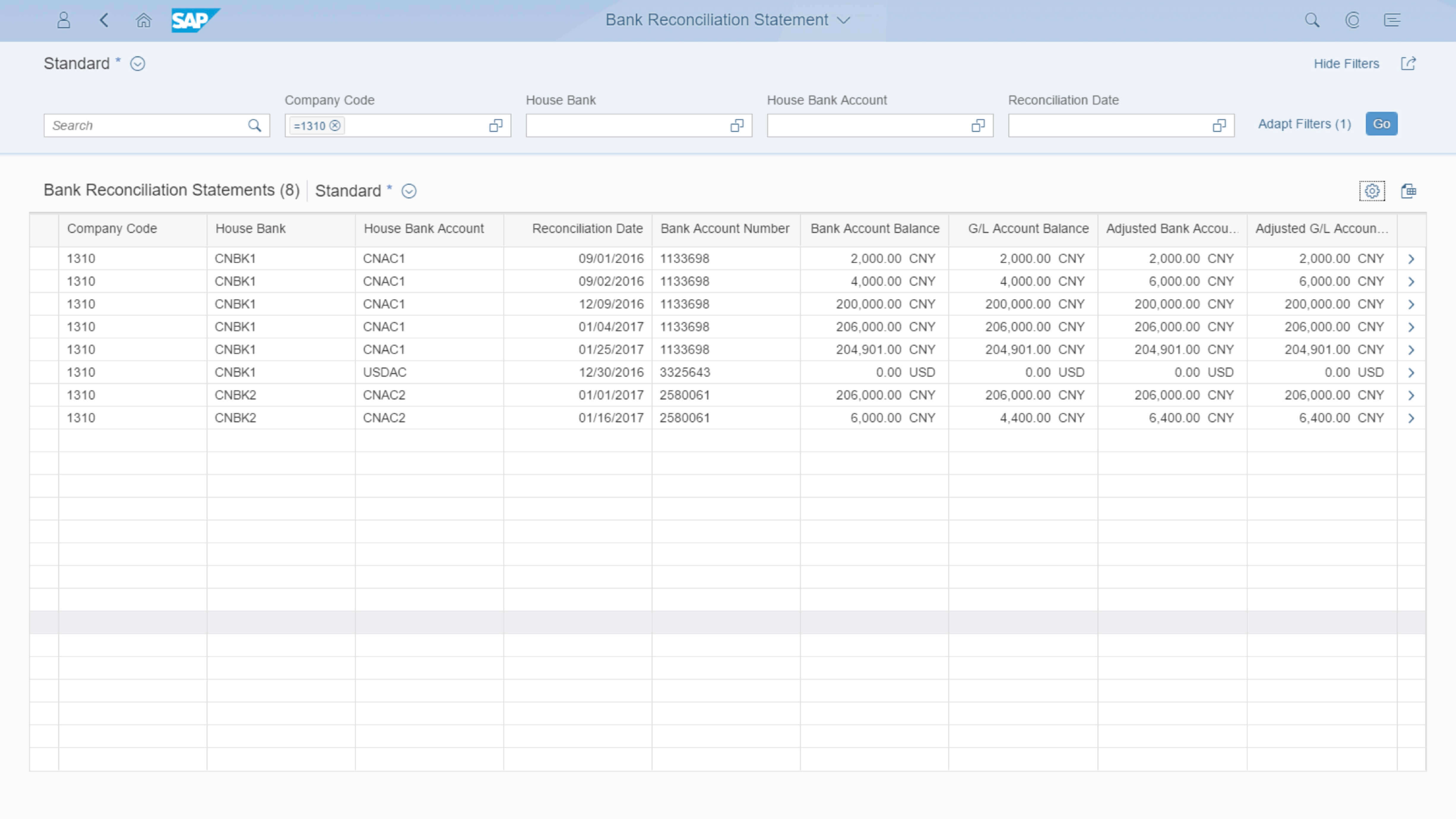

Bank Reconciliation can be performed either in source systems or in the central finance system.

Bank Reconciliation Fiori Application. Source: SAP

Bank, House Bank, and House Bank Account

Similar to the Bank Reconciliation, the integration to Bank Services through OData can be managed from the central finance system instead of the source systems. In addition, the House Bank can be defined centrally through the new Bank Master Data apps. Also, the workflow functionality has been redesigned to improve the management of bank accounts.

In-House Cash

SAP supports a virtual bank to better handle internal payments. This feature internalizes intragroup payments to reduce risk, minimize external financial costs, streamline intercompany activities, and simplify external operations.

Treasury and Risk Management (TRM)

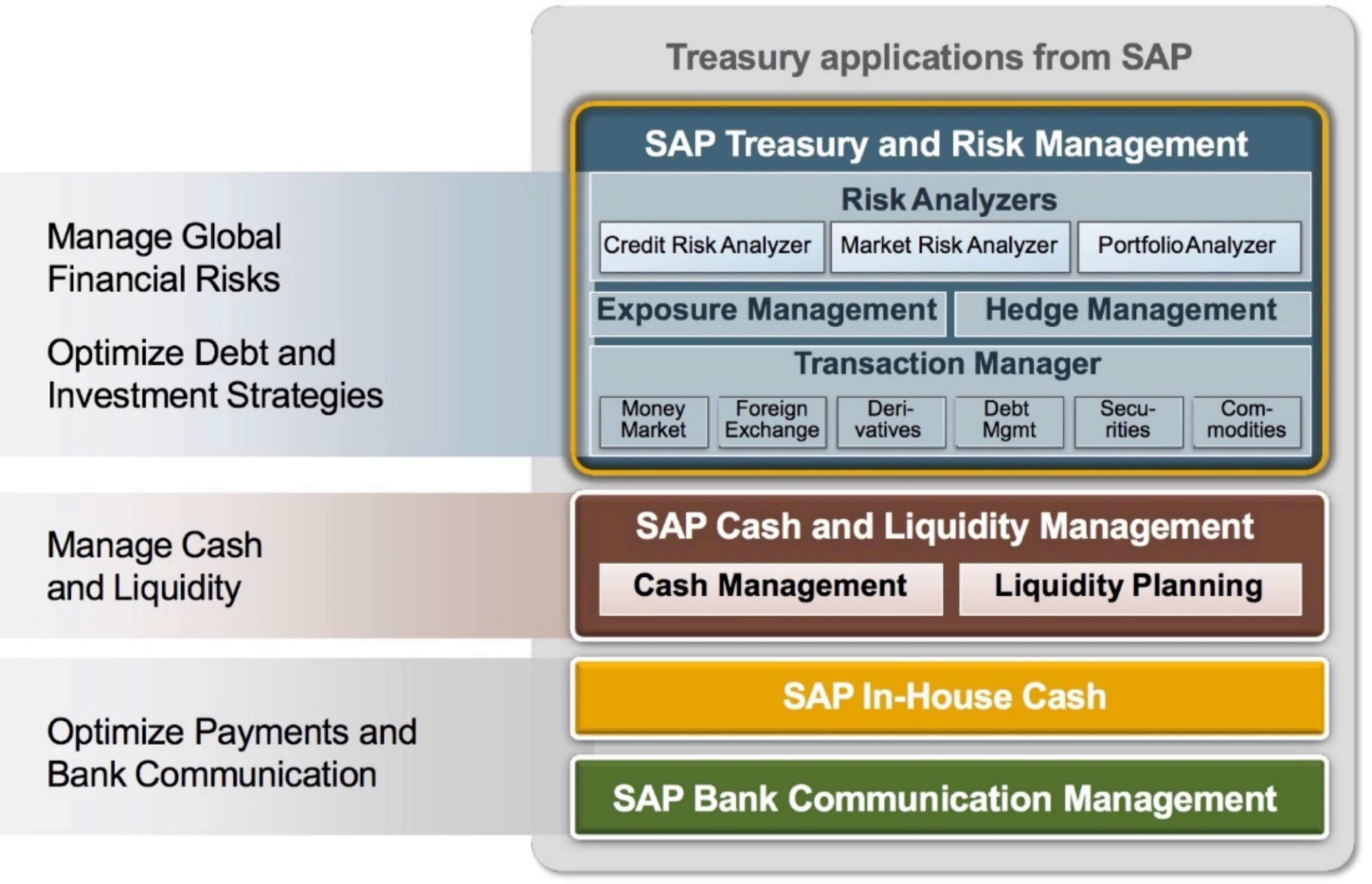

Instead of installing Treasury and Risk Management (TRM) on top of several source systems that may contain conflicting master data, central finance offers the possibility to setup TRM on top of a harmonized dataset that’s updated in real-time.

Assuming that the required master data and transaction data are connected into central finance, this deployment option will enable all features of SAP TRM:

- Risk Analyzers (Credit, Market, Portfolio)

- Exposure Management

- Hedge Management

- Transaction Manager (Money Market, Foreign Exchange, Derivatives, Debt Management, Securities, and Commodities)

SAP Treasury Applications. Source: SAP

Conclusion

For organizations relying on multiple ERP systems, treasury operations frequently turn into a spreadsheet nightmare. SAP S/4HANA deployed a central finance delivers a harmonized information model that is perfect for the deployment of applications like Treasury and Risk Management, Cash and Liquidity Management, In-House Cash, or Bank Communication.

For more information:

[1] Cash Flow Analyzer Overview

https://support.sap.com/content/dam/productfeatures/assets/00014/6CAE8B28C5DB1ED792B92BBD67F600C2/presentations/CashFlowAnalyzer.pdf

[2] House Bank Documentation

https://help.sap.com/viewer/ac319d8fa4ea4624b40a58d23e3c4627/1709%20001/en-US/715e8754dccbe85ee10000000a44176d.html

[3] SAP In-House Cash

https://www.sap.com/products/in-house-cash.html