The Business Case for Transforming Tax with SAP

Authored by Yasmine Johnson, Global Finance Transformation Tax Lead, IBM Consulting and Nuno Guimarães, Partner, TruQua, an IBM Company EMEA

Complying with global corporate taxation rules has been, and continues to be, a challenge for multinational businesses. Even for those with well thought-out strategies to optimize tax operations, focus is now directed to the data, technology, and processes needed to execute and defend such strategies. In fact, as core tax requirements such as tax return compliance and financial statement reporting have become more complex, robust technology solutions are essential. In this initial blog, we will set the stage and explain the business case for enabling tax with SAP. In future pieces, we will dive deeper into the various SAP tools and solutions that can advance tax processes across the entire tax life cycle.

Tax and the ERP – An Overview

Enterprise Reporting & Planning (ERP) systems play an increasing role in advancing tax processes. ERP systems house the financial source data that tax needs across the tax life cycle, including planning, compliance, and audit support. ERP systems with flexible cloud capabilities, such as SAP S/4HANA, are being relied upon to help tax functions manage in an environment where:

- There is pressure to create business value (a back-office tax cost-center approach is no longer acceptable),

- Tax authorities are digitizing operations and expect real-time electronic/ digital data from taxpayers

- Managing risk amidst complexity is paramount

Taxes and related processes

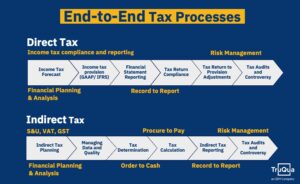

The scope of tax processes across direct and indirect tax lifecycles is broad; however, SAP is designed to address many of the tax types and processes pertaining to a tax function’s needs.

What are the taxes in scope?

- Direct Taxes – Are assessed and levied directly on the taxpayer and are generally based on taxable income or profit but include taxes on assets (Examples include income tax and property tax).

- Indirect Taxes – Are imposed on goods and services and are collected from the end customer by retailers and manufacturers for remittance to tax authorities (Examples include value-added tax (VAT), sales tax, excise tax, and import duties).

What are the end-to-end tax processes?

See below examples of direct and indirect tax processes throughout the tax lifecycle.

Figure 1: End-to-end tax processes

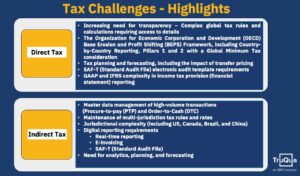

The key tax challenges

Complexity in tax is driving tax professionals to explore new ways to manage tax operations. Although global income tax rates have declined with a move towards ‘fairness’ in taxation, tax rates have increased in other areas. Taxpayers are looking for ways to reduce the overall tax burden, create enterprise value, and comply with complex and detailed reporting requirements while simultaneously managing operational risk. Below are specific examples of direct and indirect tax challenges where the Tax function is looking to technology for solutions.

Figure 2: Tax Challenges

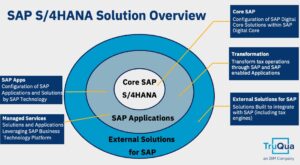

The SAP S/4HANA Cloud solution: How it operates

SAP S/4HANA is available on-premises and on cloud to transform finance operations. The SAP S/4HANA Cloud solution offers an intelligent digital core that works together with SAP, SAP applications, and external systems to modernize the ERP, providing a digital-age user experience with enhanced scalability and speed of automating business processes.

Figure 3: SAP S/4HANA Solution Overview

Core SAP S/4HANA: Includes master data and indirect tax determination based on condition logic in Sales and Distribution, Materials Management, and Finance modules.

SAP Applications: SAP apps are grouped as solutions based on SAP technology, such as SAP Tax Compliance and SAP Document and Reporting Compliance. These apps are not SAP core but are highly integrated into SAP core processes. Both apps are important aspects of SAP solutions for global tax management.

External Applications: Include third-party applications with varying levels of integration into SAP, such as tax engines (including Thomson Reuters’ ONESOURCE suite of tax solutions and Vertex) with robust integration and other external applications without integration into SAP but able to work with SAP data. These external apps include tax analytics software with API connectors or real-time analytics with a web interface.

Solving tax challenges with SAP S/4 HANA

SAP solutions for global tax management effectively meet today’s challenges in supporting tax planning, compliance, reporting, and controversy. Following are the main ways in which SAP S/4HANA facilitates tax processes:

- Automated and compliant direct and indirect tax reporting

- Rule-based data quality and tax risk management

- Automated depreciation

- Improved intercompany processes to enable transfer pricing

- Real-time digital reporting and insights into data for all tax types

See SAP Tax Management for more information on how SAP enables strategic management and compliance for the tax function.

SAP Core functionality

SAP S/4HANA’s digital core allows intelligent automation and real-time processing that enable critical tax processes. Important aspects of standard core functionality include:

- Organizational Structures – Ledger Solution – allows parallel accounting principles to be represented by using parallel general ledgers. A separate general ledger is available to support management reporting, tax, and local rules, allowing for the creation of a separate balance sheet for tax within the ERP. The full posting of the tax balance sheet presents an opportunity to automate across the tax lifecycle, from tax reporting to the preparation of tax returns, and tax planning.

Let’s look more closely at key core SAP capabilities, SAP applications, and their specific applicability for tax.

Figure 4: Parallel Accounting with Parallel Ledgers

- Universal Journal – core in-memory database technology within the finance area of SAP S/4 HANA that combines components from previously different sources into one data table, creating a single source of truth across financial, direct tax, transfer pricing, and management accounting data. It supports end-to-end direct tax processes, and these tasks can be run in real time (e.g., intercompany, currency) without the need to reconcile management reporting, under US Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), to tax data.

- Tax Determination – supported by SAP Core built-in tax calculations, it facilitates indirect tax compliance obligations globally. In some cases, due to complexity of tax rules and high volatility of tax rates (US, Brazil, Canada, and Puerto Rico are examples), SAP supports the integration of an external tax engine where a high volume of rules and rates can be maintained and quickly updated for accurate determination.

SAP applications

SAP applications complement SAP S/4HANA’s intelligent core, providing flexibility to select the right solution that is fit for specific tax purposes.

- SAP Tax Compliance – is an end-to-end tax monitoring solution that covers data along the entire tax life cycle. As part of the tax control framework, SAP Tax Compliance allows the replication of data centrally on an database or on the ERP (or hybrid) to centralize and automate checks, perform remediation, and improve the quality of tax data.

- SAP Document and Reporting Compliance – integrates tax reporting in SAP, managing end-to-end data-extraction, data aggregation, monitoring, exception handling, filing, and payment. This reporting includes periodic/statutory reporting (e.g., VAT, EC Sales list, WHT report) and addresses Standard Audit Files (SAF-T) and e-documents for electronic filing.

- SAP Analytics Cloud – can provide support with tax analytics and scenario building for preparing the tax forecast, monitoring tax cash flow, receivables, tax provisions, and the result/impact of tax audits. SAP Analytics Cloud versus SAP S/4HANA embedded analytics can be beneficial if:

- Tax data is already stored in SAP S/4HANA, perhaps in the form of master data

- Data from a heterogeneous system landscape will be merged centrally in the cloud

- External data is to be used in the analysis

- The resulting reports are to be made available to a larger group outside of the tax function, in a cloud-based format

- The tax professional is responsible for reporting as a self-service

For more information on SAP Analytics Cloud, see TruQua’s Blog.

- SAP Profitability and Performance Management – enables almost real-time profitability and cost analyses in addition to performing complex calculations and reporting, including the effective tax rate, current and deferred taxes, and tax loss carry forwards. Other important capabilities include enabling planning, scenario modeling, tax forecasting, and transfer pricing.

Transfer Pricing is an area of focus for tax functions because of the high level of tax administration scrutiny and risk. SAP Profitability and Performance Management (PaPM) can enable transfer pricing in the following ways:

- Modeling/ simulation of transfer pricing inputs and calculations

- Supporting costing in the ERP (direct and indirect cost allocations)

- Management of the process across multiple functions and stakeholders

- Generating transfer pricing relevant P&Ls, considering dimensions

- Performing write-back of new prices

- Enabling auditability and traceability within source systems

- Analytics and reporting – supporting complex reporting and documentation with visualization of data and user self-service. Integrations with SAP Analytics Cloud and SAP Digital Boardroom are available, as well as the ability to leverage the SAP Business Warehouse

For more information on SAP Profitability and Performance Management, see TruQua’s Blog.

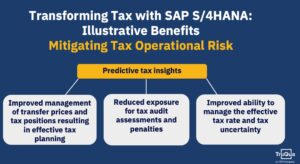

The business case

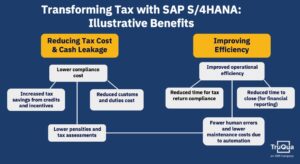

Tax functions are no longer viewed as back-office operations. Tax has stepped up to play an important role in driving value for organizations. Various metrics can be used to demonstrate value; however, they all point to key success factors for Tax – improving efficiency, reducing tax cash outlay, and mitigating operational risk.

Figure 5: Mitigating Tax Operational Risk

Figure 6: Reducing Tax Cost and Cash Leakage, Improving Efficiency

Conclusion

In developing the business case for tax transformation with SAP S/4HANA, it is important to first understand current processes and challenges. It is likely that the financial benefits to be derived from deploying SAP S/4HANA core capabilities and applications can help to fund broader tax and finance transformation. Furthermore, Tax and Finance functions will experience non-financial benefits such as improved employee morale resulting from enhanced work processes and automation. And importantly, reduced operational risk will ultimately mitigate enterprise reputational risk.

The business case analysis should consider the merits of existing tools and solutions – if and how they work along with SAP core functionality, SAP applications, and whether external tax engines or tools are needed. The SAP S/4HANA implementation is a rare opportunity to re-assess and deploy the systems and solutions that are the best fit for tax. Be proactive in asserting the tax transformation agenda early in the implementation discovery process. Understand the SAP S/4HANA implementation scope and roadmap and prepare to demonstrate the enterprise value that tax transformation brings.

To discuss these topics further, please contact TruQua, an IBM Company today by filling out the form below.

About the Authors

Yasmine Johnson is an Associate Partner in IBM’s Global Finance Transformation Practice with extensive experience in finance and corporate tax. Yasmine leads clients’ tax ERP, technology, and process enablement strategy, including assessment, defining vision and scope, and operating model design. Yasmine also leads IBM’s partner alliances for tax technology solutions. Yasmine’s previous experience includes Management Consulting and the ‘Big’ firms where she served global clients across industries. As a Corporate Tax Director, she led the tax compliance and reporting functions of large multinationals.

Nuno Guimarães, Head of IBM TruQua EMEA, has dedicated his career to helping the office of the CFO transition from compliance driven to strategy focused using modern technologies. With experience across EMEA, Latin America, and North America, Nuno has delivered finance and FP&A solutions for companies such as Google, Zurich Financial Group, Northern Trust, Allstate, Repsol, amongst others.

Sources:

SAP Press – Tax with SAP S/4HANAConfiguration and Determination

By Michael Fuhr, Dirk Heyne, Nadine Teichelmann, Jan M. Walter