CFIN+ Blog Series Part 2:

How are we doing? A quick guide to measuring and managing business performance

Introducing our CFIN+ blog series where TruQua experts cover topics relating to the future of finance transformation and best practices for driving value using the next generation of SAP finance solutions.

CFIN+ Blog Series: How are we doing? A quick guide to measuring and managing business performance

Authored by Marius Berner, Senior Business Analytics Managing Consultant, TruQua, an IBM Company

In Part 1 of this blog post, we discussed:

- The importance of a well-designed performance management and analysis strategy for measuring business performance and the return on a Central Finance investment

- How analytics, allocation rules, and simulation capabilities all play a critical role in this strategy

- What options standalone Central Finance can provide for meeting these needs, and what area its functionality falls short in

In Part 2, we will discuss some complementary tools which can enhance a Central Finance implementation by increasing both the information that can be leveraged and the flexibility for the overall performance management solution to be owned by business users.

Complimentary Tools for Performance Management

SAP Analytics Cloud

SAP Analytics Cloud, or SAC, has evolved from primarily an analytics tool into SAP’s next-generation software-as-a-service (SaaS) solution to power the “intelligent enterprise” and allow business users to plan, discover, predict, and collaborate all in one place. While many longtime SAP users are likely familiar with SAP Business Planning and Consolidation (BPC) as a planning option, SAP is moving towards a cloud-focused planning strategy. Part of this includes seamless integration with S/4HANA architecture, not only on-premise, but also with S/4HANA Cloud. This is done by leveraging the virtual Core Data Service (CDS) views that sit as the underlying layer of the Fiori applications we have been discussing. Combined with the shift towards SAP Data Warehouse Cloud (DWC) as the next generation cloud-based data warehousing approach (versus BW or BW4HANA), SAP is aiming towards a cloud-focused platform architecture with SAC as a key focal point for planning and analysis.

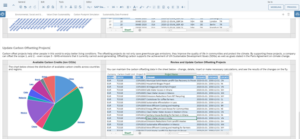

Source: SAP

Image 1: Example of a Gross Margin performance dashboard in SAP Analytics Cloud

SAC as a compliment to Central Finance provides a variety of advantages over simply using the latter in a standalone closed-loop performance analysis architecture. It provides more streamlined, strategic oriented planning capabilities that allow business users to take greater advantage of predictive analytics and simulation without IT intervention, at least at a high level. It also allows integration with a variety of data sources through both physical and virtual data access, expanding the scope of drivers and analysis axes outside of the data in S/4HANA alone. And compared to the creation of new reports and applications in Fiori, SAC provides a much easier experience for business users to create self-service analytics through “Stories.”

SAP Analytics Cloud includes features for running driver-based planning calculations off these drivers, predictive analytic modeling for identifying key drivers and modeling simulations, and allocations for running allocations on actual and plan data. While the table-based configuration provided for allocations is generally easier for a business user to work with than the configuration in S/4HANA, it has severe limitations with respect to the volumes of data it can efficiently process. You will see longer than ideal runtimes running an SAC allocation on a high volume of transactions or down to granular dimensions of detail. In addition, the table follows a very simple “sender->driver->receiver” format, with limited ability to customize offset postings, iterative cycles, or handling of unassigned items. Lastly, attempting to execute performance management allocations in SAC reveals a few integration challenges:

- First, SAC allocations can only be performed against data that is physically replicated and imported into the SAP-managed backend. Not only does this introduce data replication and latencies into the architecture for our financial journal of record (i.e., we must reimport ACDOCA to capture any changes since the last time we did so), but it limits the options a customer has to maintain tight control over their enterprise data.

- Second, while SAC has an API that seamlessly allows writeback of planning data into ACDOCP in the S/4HANA system, there are no analogous out-of-the-box export feature for pushing allocated data back into ACDOCA. This limits our ability to push the results of an allocation we would run on actuals back to the general ledger as debit/credit postings.

- And finally, while SAC has a rich library of sample accelerators for financial planning and even certain elements of planning operational metrics, its content in sustainability and ESG management is less well-rounded and covers a limited range of scenarios out-of-the-box.

- While SAP Analytics Cloud can enhance our strategic planning processes, and even augment our ability to build self service analytics to review performance, there are some drawbacks to relying on it as the calculation engine for executing the allocations needed to understand and manage that performance on deeper levels. Luckily there is an additional tool in SAP’s business analytics product portfolio that can help plug some of these gaps in our architecture – Profitability and Performance Management.

Introducing: The Software Formerly Known as FS-PER

A Central Finance standalone architecture, or even one complemented with SAP Analytics Cloud for planning and analytics, can still struggle with more granular allocations of financial and operational KPIs or with providing a strong foundation for sustainability management. SAP Profitability and Performance Management (PaPM) provides a new generation of integrated performance management applications that can use and reuse existing information models from other SAP and non-SAP applications in the cloud or on-premise, providing an additional option for augmenting the architecture to close these gaps.

Source: SAP

Image 2: SAP PaPM Cloud includes access to a visual modeler that makes it easy for business users to create powerful calculations without writing code.

- PaPM was originally conceived as “FS-PER” (Performance Management for Financial Service), a product designed to handle the complex allocation and modeling scenarios desired by banks or actuaries to assess performance of individual financial instruments, investments, and contracts. However, the power of its calculation engine led developers and customers alike to recognize use cases across a wider range of industry scenarios, and it was rebranded accordingly.

- PaPM is built on the advanced native in-memory capabilities of SAP HANA and is designed to run simply and comfortably for business users through the principles of SAP Fiori’s user experience.

- PaPM enables the integration of operational systems and data warehouses at high speeds to aggregate business data with little or no data replication. This means that S/4HANA data and other operational and ESG measures and metrics can be utilized in the PaPM performance management calculations without requiring physical replication of the source data.

- The calculation engine of PaPM allows business users to design and execute financial and business models by combining functions across a range of areas including profitability and allocation, transfer pricing, and modeling risk, solvency, and cash flow scenarios. These functions can be configured by the average business user with little to no code and can process high transaction volumes across large numbers of granular dimensions very efficiently.

- Allocation configuration is much more streamlined from creation to analysis than the multi-app configuration of S/4HANA Universal Allocations, and handles scenarios like multi-step allocations or unassigned items much more smoothly

- Remote function adapters can be utilized to write back to the results of financial allocations directly into the G/L to close the loop with Central Finance.

- The ease of iteration of the above-mentioned business rules coupled with additional simulation application capabilities enable execution of what-if scenarios for business users based on managing assumptions and drivers.

- PaPM delivers a wide library of sample content to cover a plethora of performance management topics both cross industry and specifically focused. This includes best practice content to build a sustainability management strategy around, including scenarios such as:

- Corporate Sustainability Management: Focuses on the corporate environmental performance of their business operations as well as their contributions to the wellbeing of employees and societies.

- Financing and Investment Sustainability Management: Provides an example of an ESG and credit investing method that calculates ESG and credit scores for companies and instruments.

- Value Chain Sustainability Management: Best practices for modeling an end-to-end value chain sustainability calculation model that is used to calculate and simulate the ecological footprint for a plan production accounting use case.

- Sustainability Impact Measurement and Valuation: Provides a modeling framework to perform a complete analysis of upstream and corporate operations and their direct, indirect, and induced impacts as well as their monetary equivalents for selected indicators across economic, social, and environmental areas.

- Energy Transition Management towards Net Zero: Provides best practice content for analyzing and managing a business’s path towards carbon neutrality through three core pillars: assessing emissions via the GHG Protocol, setting emission reduction targets in accordance with SBTi Net Zero Standards, and evaluating emission reduction projects through both a financial and environmental lens

- EU Taxonomy Management: Provides an end-to-end process and calculation model for companies to evaluate the alignment of their operations in line with the Taxonomy Regulation by the European Union.

Source: SAP

Image 3: SAP PaPM includes a wide library of best practice content for building out ESG calculations and performance management scenarios

PaPM adds a lot of value when designing a performance management architecture that utilizes Central Finance deployments as the system of record. However, customers should understand that this is an additional license and should assess if their requirements are complex enough to justify that. The most pervasive drawback at present is that the integration with SAP Analytics Cloud isn’t as seamless today as it is with S/4HANA. Options for consuming planning data from SAC in PaPM today require either consuming it as external OData through an API (an option only available in PaPM Cloud but not on-premise), or pushing the SAC data into another system (for example, pushing the plan data from SAC into ACDOCP in S/4HANA and consuming it from there into PaPM calculations). Comparatively, accessing outputs of PaPM calculations into SAC for analytics is significantly easier. This can be done by connecting SAC to the BW (for PaPM on premise) or HANA (for PaPM Cloud) backend artifacts that are automatically generated when the PaPM functions are activated. Additionally, integration between SAC, Data Warehouse Cloud, and PaPM Cloud promise to become more tightly connected as SAP continues investing into the vision of the Business Technology Platform.

What Approach is Right for Me?

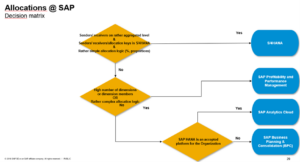

With these complementary solutions SAP offers; how does a customer ultimately determine what they do and don’t need to provide end-to-end performance management and analysis for their business leveraging their Central Finance deployment as the financial system of record? While there is no “one size fits all” answer, the following decision tree can help guide your assessment of these options.

Source: SAP

Image 4: A sample decision tree to assess the complexity of your performance management scenarios and understand which set of tools may best complement your Central Finance deployment.

Additional factors will include the appetite for beginning to manage ESG KPIs in addition to financial and operational ones. Although custom performance management content and reporting could be developed for any combination of these solutions, the best practice accelerators available in PaPM mean that including it within the architecture will drastically speed your time to value in this area.

For more information about the complementary SAC and PaPM solutions, customers can visit the SAP Help pages. Customers can also access a range of own thought leadership publications and insight blogs from TruQua experience across CFIN, SAC, and PaPM implementations through their website.

About the Author

Marius Berner is a business analytics senior managing consultant at TruQua, an IBM company, with eight years of experience designing, implementing, and delivering solutions for planning, budgeting, forecasting, analytics, performance management, and financial consolidations. Marius’s project experience ranges from end-to-end implementations, business/finance transformations, and process automation and optimization; his strong blend of functional and technical knowledge allows him to fill roles ranging from project management, business process and solution design, and technical configuration and development. Marius is a specialist in a variety of SAP technologies that support the FP&A process including SAP Business Planning and Consolidation, SAP Profitability and Performance Management, and SAP Analytics Cloud, and he is also the author of multiple blogs, webinars, and e-bites providing tips and expertise about these solutions.