CFIN+ Blog Series: Maximizing Financial Planning and Analysis (FP&A) with SAP S/4HANA Central Finance

Introducing our CFIN+ blog series where TruQua experts cover topics relating to the future of finance transformation and best practices for driving value using the next generation of SAP finance solutions.

Authored by Satwik Das, associate partner, TruQua, an IBM Company

SAP Central Finance is accelerating organization’s adoption of S/4HANA and helping them gain significant value by consolidating and simplifying their systems and processes. This finance transformation also leads to major benefits in downstream processes like Financial Planning and Analysis (FP&A). With a central universal journal as the single view of truth and a harmonized chart of accounts, the data requirements for FP&A processes are faster to realize and easier to reconcile, and the business can focus more on planning and analytics. SAP Analytics Cloud also provides further opportunities for analytics using live reporting on source data. This blog explores all the opportunities made available to improve the FP&A process with Central Finance as well as the different modeling options to gain maximum benefits from your implementation.

Financial planning and analysis focus on an enterprise’s financial health. As the name suggests, there are two key aspects to FP&A:

- Analyzing the finances and associated drivers of an organization, identifying root causes and variances, and exploring key areas of risks and opportunities.

- Planning and forecasting for the future to chart out the best path to optimize and use the organization’s finances.

All activities related to financial performance management and key KPIs, planning and budgeting, and management reporting fall under the purview of FP&A.

Where has FP&A struggled?

The data requirements for analysis and that can serve as the basis for planning have become more detailed (higher level of information present for financial transactions). The speed of access to this data during analysis and planning is paramount to ensure agility.

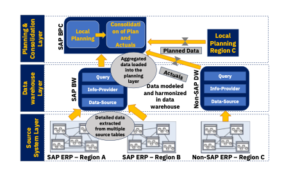

Historically, these have been the stumbling blocks for the FP&A team. Accessing highly granular data while carrying our FP&A processes was a challenge due to system constraints. The process involved extracting the granular data from the source system and staging in a data warehouse, which was complicated depending on the data requirements. There were different source tables to extract data for financial and management reporting. For even more granularity, data from subledgers like A/P and A/R needed to be extracted. This data then had to be transformed, joined, and modeled in the data warehouse to enable the required reporting and planning. Since, planning typically aways happens at a more aggregated level, the granular data being staged in the data warehouse solely served the purpose of reporting. These extraction, transformation, loading, and modeling processes necessitated heavy involvement of the IT team, resulting in increased time to realize and loss of agility.

For larger enterprises that had multiple source systems with different chart of accounts and processes, these issues were compounded.

Figure 1: General flow of data for FP&A solutions

Figure 1: General flow of data for FP&A solutions

S/4HANA and Central Finance

S/4HANA addresses a lot of these shortcomings with the simplification of the overall ERP architecture. Powered by the speed of the underlying HANA database, S/4HANA architecture was simplified with one universal journal for actual financial data (ACDOCA) and one for plan data (ACDOCP). This meant that there was no longer a need to access subledgers for more details. Variance reporting between actuals vs. plan can be based on these two underlying tables.

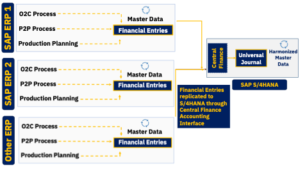

Implementing S/4HANA meant that the organization had to move all their processes (financial, sales, material management, production, etc.) to the new system, and the reporting and simplification benefits could not be realized until the overall implementation was completed. Central Finance is a ‘finance first’ approach that enables replication of all finance data at real time from the underlying source system into an S/4 system. Any financial document that results from an underlying transaction in the existing source system is also replicated to the universal journal table in the target Central Finance system immediately. This enables the Finance and FP&A team to benefit from the new S/4HANA features much faster. This also helps with change management where the finance team gets acquainted to the S/4 functions and features before the rest of the processes are implemented in the system.

Central Finance is also used to replicate finance data from multiple source systems and report on them centrally using a common chart of accounts and other key dimensions. This makes reporting and planning processes much simpler for the FP&A team since the harmonization across the different sources is already done in the Central Finance source system.

Figure 2: Central Finance and S/4HANA

What this means for FP&A?

Central Finance based finance transformation provides strong opportunities to improve and optimize the FP&A processes. As a result, there are many changes and improvements that have come about around the Central Finance ecosystem. Tools like SAP Analytics Cloud (SAC) and Profitability and Performance Management (PaPM) have been enhanced and features added to these to tighten the integration with Central Finance and unlock more possibilities to provide seamless analysis and planning functionality to the users.

Enable centralized planning and reporting

Larger enterprises may have multiple regional/divisional source systems, with each region and division having its own planning platform and separate processes. Budgets and forecasts from these planning platforms then need to be consolidated into one central location for an organization-wide view.

One of Central Finance’s key use case is harmonizing financials and associated master data within one single platform. A single source for financials in turn creates a strong case for a central planning platform that is based on this harmonized Central Finance system. All divisions and regions can carry out their planning and budgeting within the same platform, thereby removing the requirement of sending the planned data to a separate central platform.

Improved Analytics

Reporting tools can connect directly to Central Finance and report on the universal journal financial data. Some of the key reporting tools that can be used are SAP Analytics Cloud and Analysis for Office, as well as non-SAP tools like Power BI. Since the universal journal has all the financial data, detailed reporting is possible using these reporting tools. The reporting is also real-time, meaning that the latest numbers are available in the reports as soon as the transaction is posted.

This enables organizations to preserve their existing investments and use their existing tools like Analysis for Office for their analytical needs. SAP Analytics Cloud can be used for more sophisticated visualizations and dashboards. There are pre-delivered views (called CDS views) in Central Finance that can be used for out of the box reporting without any need for extracting data into a separate data warehouse. Central Finance/S/4HANA also provides pre-delivered Fiori Applications for reporting. There are pre-delivered Fiori apps for common reporting requirements like Trial Balance Reporting, Receivables and Payables reporting, as well as common KPIs like Aging reports. You just need to activate these Fiori applications and report on it, thereby significantly reducing maintenance and time to realize.

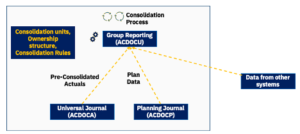

Faster Closing with Group Reporting as the central consolidation platform

Financial consolidation and external reporting of an organization’s financial health is one of the key finance responsibilities. These have typically been done in separate consolidation platforms like SAP Business Planning and Consolidation (SAP BPC) or other tools like Hyperion, etc. This required data needs to be extracted from the source system, loaded into these consolidation platforms, and then run from the various consolidation rules before reporting. Consolidations in Central Finance can now be done using Group Reporting which is a part of the same Central Finance system. Data is replicated into a central Group Reporting table (ACDOCU) before running the consolidation rules. There is flexibility to choose the different dimensions that are relevant for the consolidations and reporting; hence there is potential to do much deeper analysis on the consolidated numbers.

As with the universal journals, various reporting tools like Analysis for Office and SAP Analytics Cloud can easily connect to the central consolidation table for reporting and visualizations, and the consolidated data can also be interfaced to other platforms if required.

Using Group Reporting moves the consolidation process closer to the source system and thus results in faster closing using more up to date data.

Figure 3: Group Reporting

Moving processes closer to the source

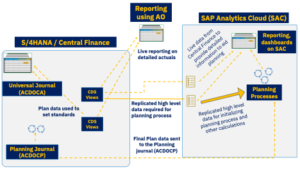

As with Group Reporting, moving FP&A processes closer to the source is one of the key themes of Central Finance. With SAP Analytics Cloud it is now possible to report directly on the Central Finance data without the need to replicate granular details. This enables organizations to only load any relevant high-level data for planning while using the same SAC platform to carry out live reporting on the granular data to supplement the planning process. Live reporting is based directly on the data from the Central Finance systems. These could be based on any pre-delivered or custom CDS views. SAC visualization and dashboards can be set up on the live data from Central Finance while planners refer to this during the planning process. The Central Finance system is the source of truth and there are no reconciliation steps involved.

Faster time to realize

With much of the data harmonization already done at the source, and ability to pull detailed transaction directly from the source, the modeling becomes much easier and leaner. You may not need a lot of harmonization before data is made available for planning. Only data at the relevant level of granularity need to be pulled from the universal journal using standard CDS views. This leads to faster realization of the models and the focus can be on setting up the planning process, rather than data transformation. The FP&A team can also focus on the planning and analysis aspects instead of spending most of their time on data reconciliation activities.

In many cases, there may not be a need for a separate data warehouse, thus reducing maintenance efforts and IT ownership.

Figure 4: Planning process integration with Central Finance

Tighter integration with planning processes

The ACDOCP table in Central finance is the universal table for planned data. There are tight integrations with SAP Analytics Cloud to move the data from SAC into the ACDOCP table once the planning process is completed. This option enables the final plan data to reside within the Central Finance system that can then be consumed by Fiori or other reporting application, and can be used in the core management processes.

For example, activity rates can be calculated based on the production planning process in SAC which then can be moved to the planning table in Central Finance and can be used as the rates going forward. This can replace the activity costs being done in cost center planning (transaction KPO6) and activity price calculations (transaction KSPI) in the source. In this case, SAC becomes the single source for all planning.

Refer our book published by SAP Press to learn more about Financial Planning and Analysis using SAP Analytics Cloud

Re-imagine overall FP&A landscape

Central Finance changes the overall FP&A architecture by being at the center of all processes with tight integration with other platforms in sharing actuals and plan data.

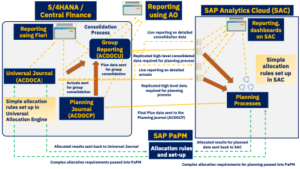

S/4HANA using Central Finance opens many possibilities where it can interoperate with SAC and PaPM to achieve key management reporting and planning requirements. One of these key areas is allocations. Allocations can be done using the Universal Allocation Engine (UAE) of S/4HANA. This can be used for allocation of both actuals and plan data. One possible architecture could be where SAP Analytics Cloud sends across plan data to S/4HANA for final allocations. All rules are maintained in S/4HANA. Another option could be where allocation for actuals takes place using UAE in S/4HANA while allocation of planned data is done in SAC.

Some of the more complex allocations may require PaPM. PaPM can sit directly on top of the S/4HANA/Central Finance system and can read the actuals from the universal journal (ACDOCA) and carry out cost center, profit center, and other allocations as well as write back to the universal journal. For planning data, SAC can now call PaPM processes to run the more complex calculations required on plan data and can then send the allocation results back to Central Finance. The figure below depicts such a scenario.

Based on the allocation complexity, volume, and existing system landscape, any of these options can be implemented to support the FP&A process. For more information on PaPM, please refer to our blog series on this topic.

Figure 5: FP&A with Central Finance, SAC and SAP PaPM

Central Finance presents opportunities to make the FP&A processes leaner and more efficient and allows the FP&A team to concentrate on their core area of analysis. It is at the core of an organization’s finance transformation and enables them to rearchitect their overall FP&A landscape. For more information on how your FP&A organization can get the most benefits out of your Central Finance implementation please reach out to TruQua, an IBM company.![]()

About the Author

Satwik Das is an associate partner at TruQua, an IBM Company. He has more than 15 years of experience leading and managing large-scale SAP analytics, financial planning, and finance transformation projects. Satwik has extensive experience in SAP Business Warehouse, SAP Business Planning and Consolidation, and various reporting tools, and he has worked with clients to implement SAP Analytics Cloud as the platform for their financial planning and analytics (FP&A) processes. He has also managed blueprinting involving SAP S/4HANA and Central Finance. Satwik enjoys architecting and designing solutions to manage clients’ complex reporting and planning needs.