IBM Intelligent Mapping for Finance: The Proactive Approach to Finance Transformation

Authored by Nick Gonzales, Senior Consultant & Developer, TruQua, an IBM Company and Frank Ferris, Managing Consultant, TruQua, an IBM Company

Introduction to Chart of Accounts Harmonization

Imagine driving a car along a highway full of nails and glass, stopping each time to get out and remove the debris. The time it takes to reactively address all these obstacles is a painstaking and ineffective approach to travel. But unfortunately, this approach too often describes system implementations.

As much as teams can try to plan for roadblocks, the complexity of Enterprise Resource Planning (ERP) systems means there will always be unpredictable functional and technical issues that arise during build and test. If there were a feasible way to survey the roadway in advance of your journey to proactively plan your route and remove obstacles ahead of time, this would help immensely.

Introducing IBM Intelligent Mapping for Finance (IMF): IMF clarifies the path to standard by helping implementation teams predict and clear potential roadblocks as early as the discovery phases. In this blog, we’ll explain how IMF can help teams shift towards the proactive approach to finance transformation, with a focus on the Chart of Accounts.

Real-World Client Example

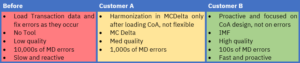

TruQua and IBM recently partnered with a leading automotive company on their SAP S/4HANA finance transformation with Central Finance and leveraged the IBM Intelligent Mapping for Finance solution throughout the course of the engagement. By using IMF, this customer was able to improve the speed and efficiency of their implementation, allowing the project team focus on their design/process strategy from the beginning rather than spending days, weeks or even months on error resolution and fixing mapping errors.

IMF contributed to a significant reduction in general ledger mapping and master data errors in the Initial Load process. In previous comparable projects, the master data related errors accounted for 25% of all errors, while with IMF, the errors have been reduced to account for only 0.05% of the total errors.

Benefits for Clients and Project Teams

Functional Benefits

As part of SAP S/4HANA Central Finance projects, finance teams must move to one central Chart of Accounts, often from a disparate source landscape with multiple operating CoAs. By conducting analysis on the charts of accounts and other master data during the pre-implementation phases, teams can eliminate uncertainties and gain an edge on accurate scoping and timeline for the implementation phases.

During the implementation phases, teams can visualize mappings and ensure they are valid to design an effective target chart more easily. IMF gives teams greater flexibility to iterate on changes without introducing unknown issues as well as experiment with multiple versions of the CoA to standardize more easily. Benefits of standardization include:

- Elimination of account proliferations by leveraging S/4 dimensionality (function, region, department, etc.).

- Use of smart numbering and naming conventions.

- Limiting the number of manually posted accounts.

Technical Benefits

During SAP S/4HANA Central Finance projects, the Initial Load and replication processes must consider the technical constraints surrounding attribute consistency in general ledger account master data between source and target systems. The key attributes (e.g., Open Item Management indicators, Balance in Local Currency Only indicator, and Reconciliation Account Type) have technical restrictions in addition to implications for an organization’s business processes that may be in scope for an S/4HANA transformation.

The activity of aligning or “harmonizing” the key technical attributes is often a tedious, manual, and reactive process that can take upwards of weeks or months over the course of the Initial Load of transactional data from source ERP systems to Central Finance. The traditional approach to this process involved analyzing errors resulting from attribute conflicts in general ledger master data during the historical transaction data load or ongoing replication to Central Finance, manually applying corrections within the source or target system and tracking in offline spreadsheets.

With IBM Intelligent Mapping for Finance (IMF), this process gains a great degree of automation, shifting from a reactive to a proactive approach to error resolution that can be carried out before the project team ever logs into the organization’s systems. By shifting the mapping exercise and future state Chart of Accounts design to this earlier phase in the project, implementation teams see an enormous time savings with respect to this once heavily manually process. By centralizing the mapping and Chart of Accounts design within the tool, IMF also becomes a living repository for finance master data throughout the project and, even the application life cycle.

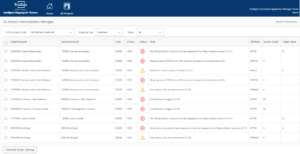

Figure 1: Visualization of mappings

Using IBM Intelligent Mapping for Finance

Preparation

The first step to using IMF is to collect and prepare the master data necessary to execute a project in the tool. Each IMF project requires legacy source system data from any number of source systems as well as a reference or prototype of the future state Chart of Accounts master data. This reference future state Chart of Accounts can be based on a merge of the legacy Charts of Accounts, a Best Practice reference Chart of Accounts, an existing operational Chart of Accounts, or some combination of the three. The master data can be ingested into the tool through flat file uploads of table extracts or through remote pulls of the data via integration with the systems.

Map Company Codes

Once the reference master data has been loaded into IMF, the next step is to map the legal entities or Company Codes in scope for the implementation. This can be done by configuring automated attribute-based mapping rules or through a flat-file upload if the mappings are known. After the company code mappings are finalized, the G/L mapping and target Chart of Accounts refinement process can begin.

Map G/L Accounts (Create / Refine Chart of Accounts)

There are technical constraints and business process considerations when designing the future state Chart of Accounts for a Central Finance or S/4HANA implementation. Addressing these constraints proactively and with a great degree of automation is where the solution really differentiates itself with its intelligent G/L mapping capabilities, saving time and effort for the project team and ensuring confident chart design.

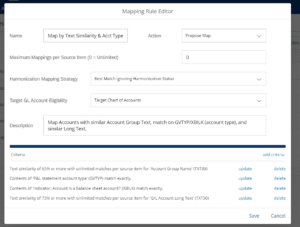

One or more attribute-based mapping rules can be configured using an intuitive UI on any G/L master data characteristic, including account numbers, text descriptions or a common group / consolidations account. These rules can be relatively simple or incorporate considerable complexity by leveraging natural language processing, exact text matching, ‘starts with/ends with’ criteria, and more. The system will then automatically map the accounts or suggest proposed mappings for the user to review, reject, or approve using IMF’s workflow capabilities. If the result is not as expected, the mapping rules can be easily reconfigured and rerun.

Figure 2: A view to configure a mapping rule with one or more mapping criteria.

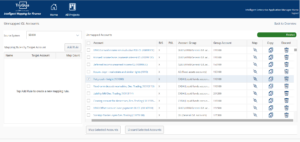

Figure 3: A view to map any remaining Unmapped accounts manually.

Demo: IBM Intelligent Mapping for Finance + GL Account Mapping

Harmonization

While the mapping capabilities of IMF are powerful on their own, the built-in logic to harmonize these mappings by detecting and addressing technical conflicts is even more impressive. Leveraging the implementation experience of TruQua and IBM project teams, as well as SAP’s guidance on master data harmonization, the system checks mappings as they are created for any invalid attribute combinations between the source and target systems. For instance, non-reconciliation accounts cannot map to reconciliation accounts. At any point during the mapping exercise, these conflicts can be viewed and iteratively addressed either by remapping, aligning the target attribute value from source when possible, or by automatically generating new ”replication” accounts.

So-called “replication accounts” are accounts that are created to resolve inconsistencies between other mapped accounts, particularly where remapping or attribute changes are not possible. This approach is useful in case the relevant accounts or Company Codes are mapped N:1, since switching the target setting would just flip the conflict to other source objects. The creation of a replication account in the target system’s Chart of Accounts resolves this issue by moving the mapping in conflict to a new account with harmonized settings.

Figure 4: A view displays errors between mapped accounts with inconsistent settings.

Export Mappings & Master Data

Once complete, the user can export both the master data and mappings in the template structure required by the S/4HANA Data Migration Cockpit and the Central Finance mapping upload framework. This template export functionality provides a substantial time savings in manual and offline data preparation for these load processes.

Product Roadmap

In addition to the product mapping capabilities around general ledger master data, similar functionality is being developed for other financial master data objects and processes such as:

- Cost Center and Profit Center

- Vendor, Customer, Business Partner

- Multi-dimensional mapping

Closing Remarks

IBM Intelligent Mapping for Finance helps implementation teams work together to reach a standard and common definition for their target Chart of Accounts when implementing SAP S/4HANA Central Finance, especially with a disparate source landscape. IMF features robust mapping and data harmonization capabilities that help teams predict and clear roadblocks as early as the discovery phases.

To learn more about the capabilities of IMF, please contact TruQua using the form below.

About the Authors

Frank Ferris is a certified SAP Finance professional with 6 years of experience working with a variety SAP products and technologies supporting clients in the manufacturing, consumer packaged goods, pharmaceuticals, aerospace and automotive industries. Frank’s primary focus is aiding organizations undergoing Finance Transformation initiatives enabled by SAP S/4HANA and SAP Central Finance.

Nick Gonzales is a Chicago-based SAP Finance Consultant and Developer with experience across industries including pharmaceuticals, manufacturing, and automotive. Currently, Nick’s work involves development on the IBM Intelligent Mapping for Finance (IMF) application and deployment of IMF as part of SAP S/4HANA Central Finance transformation initiatives, with prior experience including FP&A work with SAP Analytics Cloud and SAP BPC. When he is not in a finance system, Nick enjoys volunteering and coaching for his local rowing club.