SAP’s Investment in Planning and Consolidation: What it Means for You

Authored by JS Irick, Associate Partner, TruQua, an IBM Company; Klaus Satzke, Associate Partner, TruQua, an IBM Company; Sonal Bhujbal, Senior SAP Consultant, TruQua, an IBM Company

Every organization which intends to follow SAP’s strategic direction for planning needs to have a rock-solid strategy for migrating to SAP Analytics Cloud (SAC). In this blog we will present the data necessary to craft such a strategy.

First, we will look at the SAP’s latest published estimates for BPC’s (SAP Business Planning and Consolidation) end of maintenance, combining that data with the BPC team’s actual development output. Next, we will look at the last year of SAC development coupled with the published roadmap. Finally, we will present our perspective based on the available data.

All data presented in this blog is public information released by SAP. Any roadmap information falls under their safe harbor statement. Any subjective statements are solely the opinion of the author.

The latest BPC End of Support data can be found in PAM here.

The SAC roadmap viewer can be found here.

All Development Data is sourced from SAP Support Portal:

Thank you to Sonal Bhujbal for the data curation and visualizations. Without her hard work this article would not have been possible.

The Future of SAP BPC

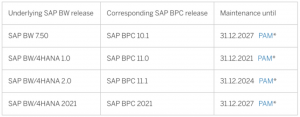

Long term planning for SAP BPC starts with an understanding of End of Maintenance dates. Thankfully SAP has provided an easy-to-understand chart:

Figure 1: SAP BPC End of Maintenance Dates (Source: SAP)

This raises a follow up question: With new SAC functionality releasing constantly, what level of continuous improvement should we expect from BPC?

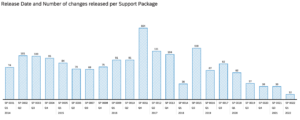

First, we can look at a trend line of released code changes to SAP BPC over time (in this case, SAP BPC 10.1 on SAP BW 7.5):

Figure 2: Release Code Changes to SAP BPC 10.1 on SAP BW 7.5

Figure 2: Release Code Changes to SAP BPC 10.1 on SAP BW 7.5

This chart shows a strong, but steadily declining pattern of continuous improvement in SAP BPC. Which key components are receiving the most development?

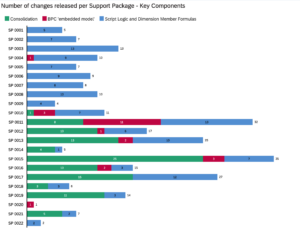

Figure 3: Patterns of Continuous Improvement to SAP BPC

Figure 3: Patterns of Continuous Improvement to SAP BPC

Here we see that both the planning engine and regulatory consolidation engine are receiving continuous development. It is important to view development from this perspective as SAP must continue delivering consolidation fixes for their customers’ statutory/regulatory requirements. Therefore, it is a strong marker that the Planning engine continues to evolve.

This high-level analysis provides a baseline understanding of the future of BPC. Continuous (though declining in volume) delivery across all features of the product. Let’s take a deeper dive into Support Package 23 to gain a more nuanced understanding.

Support Package 23 has approximately 50 notes, making it the largest support package since January 2020. Of those 50 notes, 47 are code remediation/fixes, and 3 are functional enhancements. The functional enhancements include an update to enable more complex eliminations. Of more interest is an improvement to how the query engine handles certain kinds of hierarchies (ones with many leaves near the root node). This kind of targeted performance enhancement is exciting, as it shows a dedication to the user experience.

SAC Improvement Analysis

In reflection, 2021 was a strong year for SAC development. Most critical (what I would call the lighthouse achievement) was the delivery of the “New Model”, a redesign of the core data architecture for SAC. All future development depended on this transition, so it was a huge accomplishment for the team to achieve this milestone.

One area of concern is that no migration path from old model to new model was provided. While this could raise concern about interoperability of future enhancements, it is my belief that there is no change of this scope in the foreseeable future.

Other milestones include:

- Workflow improvements (teams and multiactions)

- Major performance improvements (stories and planning)

- Incremental reporting improvements

- Pre-delivered content

While I see this as a strong year, it is up to the reader to use this information to determine SAP’s ability to execute on future roadmap items (that is: how many improvements can you expect in a year?).

Looking at the 2022 roadmap, I see the following highlights:

- Lighthouse Achievement: Customization for Time Dimension. This is a critical product gap and is huge for manufacturing and retail customers

- Data Warehouse Cloud integration

- Story 2.0 (overhaul of reporting layer to combine distinct features)

- Open export API/triggering of external API

- Improved Planner UX and responsiveness

An impressive roadmap to be sure. While this feels optimistic based on 2021’s delivery, without knowing the exact challenges of the New Model conversion, I can’t comment past that. I will say that on the rare occasion features have been delayed, it was in service of delivering those features successfully. “Worth the wait”, so to speak.

Klaus Satzke: POV on Adoption of SAP Group Reporting

For SAP customers running consolidations on BPC, the switch to SAP Group Reporting is most often undertaken with the adoption of the overall Finance solution on SAP S/4 HANA. This pattern of adoption seems to follow SAP’s product positioning pulling Consolidation from a stand-alone application into the core of S/4 HANA.

SAP Group Reporting has matured as solution and seems the logical extension of the S/4 HANA’s ledger concept, Universal Journal, and finance master data integration. The introduction of SAP Group Reporting Data Collection has closed the gap to connect to different data sources to gather financial data.

In the consolidation process area, SAP has added innovation features like Intercompany Matching & Reconciliation (ICMR) that allow customers to embrace continuous accounting with a high degree of automation and intelligent machine learning features.

On the reporting side Group Reporting offers Fiori tiles, but SAP Analytics Cloud (SAC) can be an impactful extension for Structured Reports, Dashboards, Advanced and even Predictive Analytics.

With the addition of Group Reporting Data Collection (GRDC), SAP opens consolidation as a possible stand-alone solution as it addresses web-forms, comment collection, and mappings of both SAP and non-SAP source data into group reporting.

Conclusion

Having analyzed the data, I can state two conclusions with confidence:

- SAP continues to invest in bugfix, performance, and functional improvements for BPC. These improvements touch both the planning and consolidation components of the product

- SAP is delivering continuous improvement in SAC and is successfully launching their “Lighthouse Improvement” each year. These improvements include key features that may impact whether your organization can use SAC to its fullest capabilities as a planning solution.

Based on having a stable foundation over the next half-decade and a constantly improving future, BPC customers are in a strong position to make the most of this migration. One approach our clients have found incredibly successful is to move one key decision or planning process to SAC. We help clients find the right planning scenario to utilize the strengths of SAC.

Consider the following signs of a strong candidate for migration to SAC:

- You are looking at multiple scenarios for a given forecast. Leveraging SAC’s versioning and variance analysis tools means you can better understand the impact of proposed business decisions.

- There is an occasional, non-excel focused user base. SAC’s web-based UI and “story” focused UX means users can access/plan the critical data quickly and then take advantage of the embedded analytics for further data mining.

- There is a mandate to change/enhance a poorly performing process. While SAC is an excellent planning platform, change for its own sake will not give you the impact you desire. Instead, leveraging the strengths of SAC to attack a new problem can lead to the desired transformation.

- Your planning process includes heterogenous data, or a combination of operational and financial data. SAC’s strong integration coupled with its driver-based planning and data blending capabilities is a great fit for these types of planning scenarios.

With BPC’s long-term viability and SAC’s integration capabilities, BPC (and non-BPC) customers have an opportunity to prioritize key areas of their planning process. Instead of emulating the as-is, we are partnering with organizations to achieve targeted innovation. For more information, please contact js.irick@ibm.com, we’d love a chance to whiteboard with you, and discuss how to increase the strategic impact of your planning processes. In 2022 our goal is to help you own the key decision.

About the Authors

JS Irick has the best job in the world; working with a talented team to solve the toughest business challenges. JS is an internationally recognized speaker on the topics of Machine Learning, Enterprise Planning, SAP S/4HANA and Software development.

Klaus Satzke is an SAP Finance Transformation Leader at TruQua, an IBM Company. Klaus is focused on SAP driven Finance Transformation, developing roadmaps, and helping clients solidify their SAP strategy.

As a senior SAP consultant, Sonal Bhujbal is focused on implementing CFIN projects that involving S/4 HANA design configuration, GAP analysis, and solution delivery for clients.