What are Side Panels and how can they be used in SAP Central Finance?

What are Side Panels and how can they be used in SAP Central Finance?

Matt Montes is an SAP Financials Senior Consultant and Trainer at TruQua Enterprises.

Ever wondered what analyzing financial documents in SAP would be like without the laborious need of flipping from screen to screen and logging into multiple systems? Well, now you no longer have to wonder. This is a reality and it is an absolute game changer.

In a previous blog entitled “Central Finance Drill-Back to Source Document via SAP GUI and Fiori”, I introduced using Central Finance as a stepping stone to SAP S/4HANA and discussed the ability to drill-back to a source system document seamlessly. Now with Side Panel functionality, end users can access Central Finance document level visibility in the opposite direction (i.e. see the downstream Central Finance document details from within the originating document in the SAP source system). This is achievable through the use of SAP NetWeaver Business Client and Central Finance Side panels.

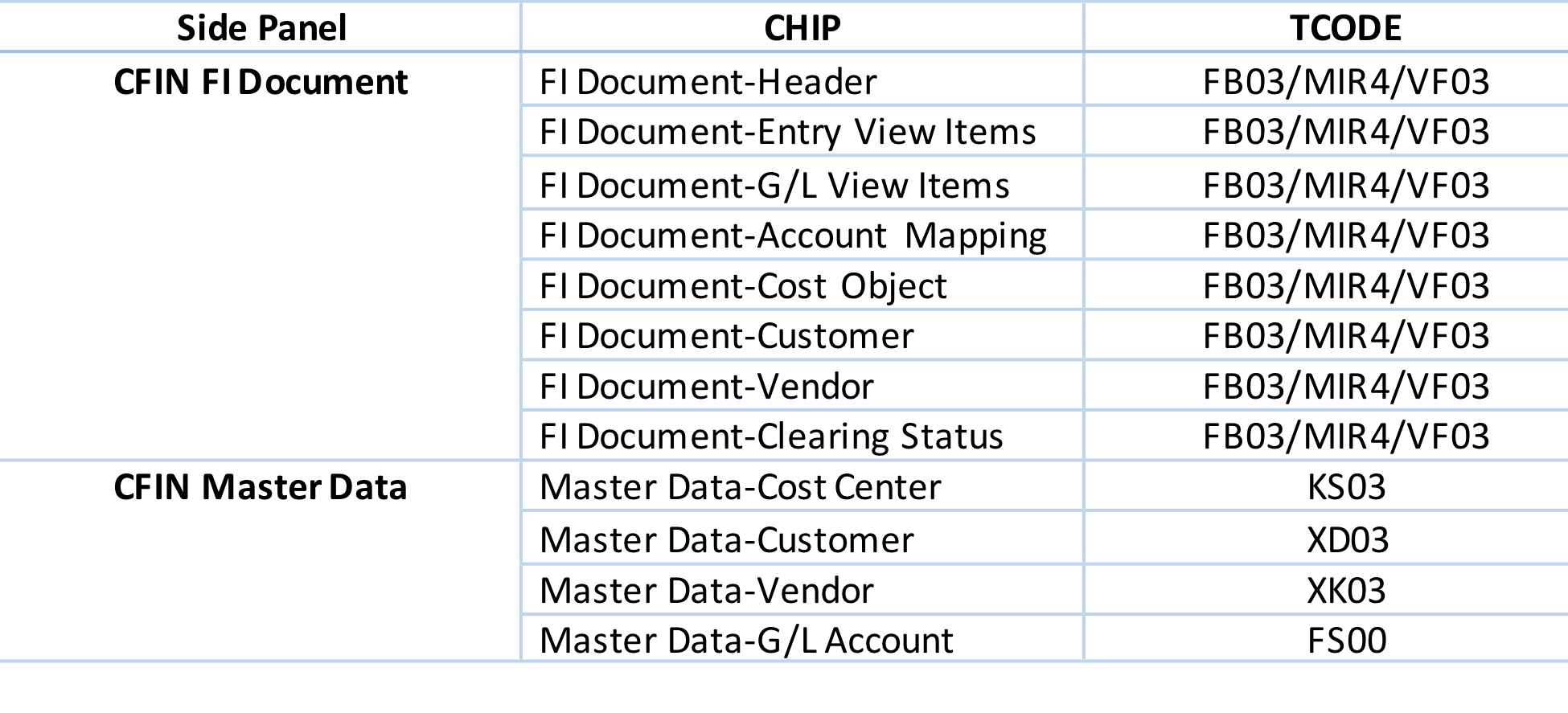

Side panels are exactly what they sound like, a side panel being displayed on the side of whatever transaction you are currently accessing. CHIP’s (short for “Collaborative Human Interface Parts”) are the different views being populated throughout the Side Panel that contain a variety of data. Side panels can be leveraged to display financial document information from the Central Finance system while in a source system transaction or vice-versa. Through the use of NetWeaver Business Client (NWBC), Remote Function Calls (RFC), and CHIP’s, FI document information and Central Finance master data can be retrieved and displayed as a side panel.

What do they look like and what information do they display?

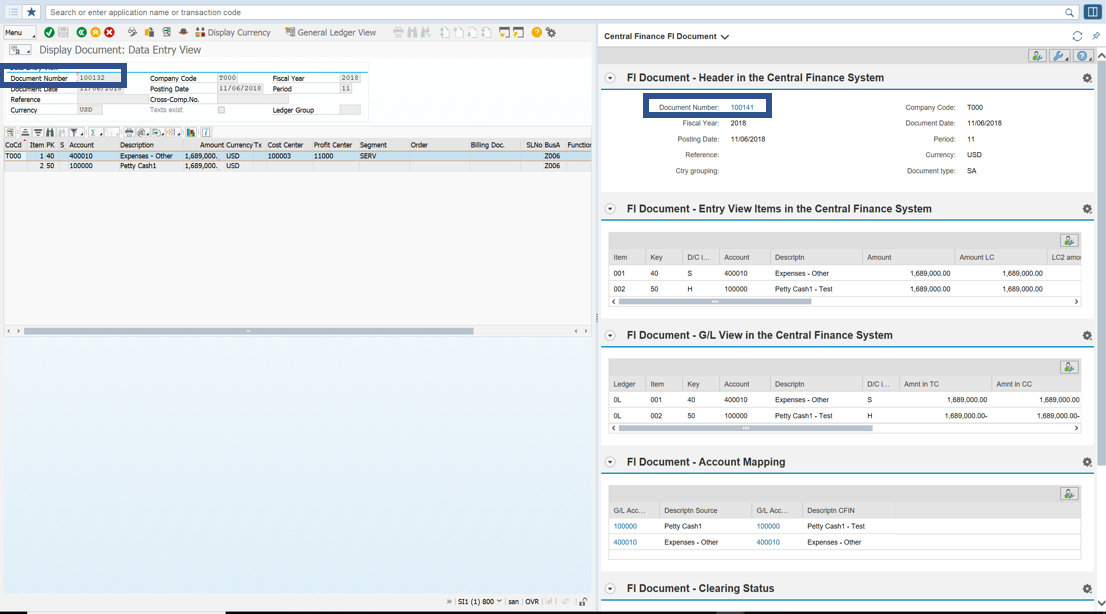

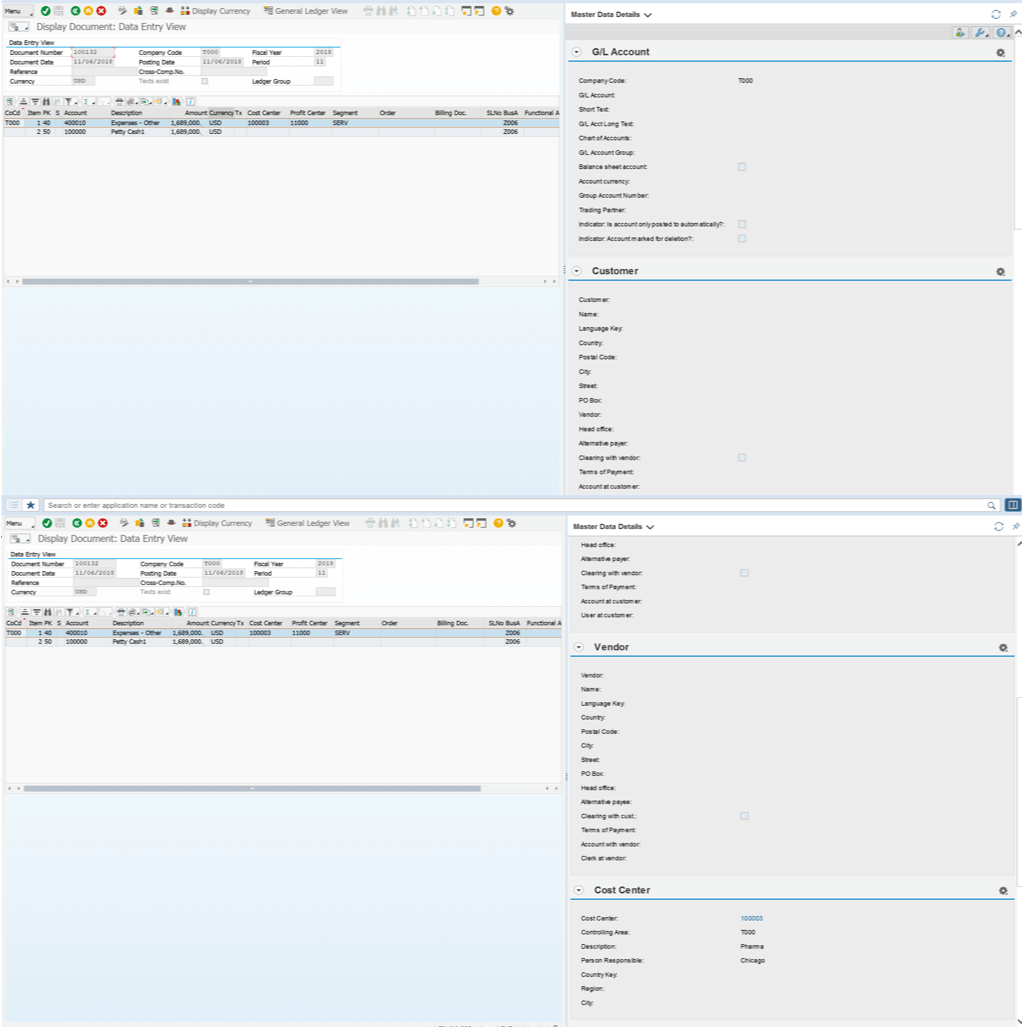

At the time of this writing, there are two side panels and thirteen CHIPS that come system delivered with Central Finance. Figure 1 highlights what one of the Central Finance Side Panels looks like when accessing the data from a source system.

Figure 1 – Source System Side Panel

Side Panels can be accessed via the source or Central Finance system, with each CHIP displaying an array of information contingent on the TCODE and system (source or target) that you are accessing (Figure 2). For example, when accessing the FI Document-Header CHIP in the source system, the header information displayed will reflect the information stored in the Central Finance system. However, when accessing the FI Document-Header CHIP in the Central Finance system the information displayed will reflect the header information stored in the source system.

Figure 2 – Source System Side Panel (1)

As you saw in Figure 1, the FI Document side panel is accessing target system information via the CHIP’s listed in Figure 2. By quickly comparing the two document headers one can notice that the source system and target system document numbers are different. Additionally, one can quickly determine if there is any account mapping occurring between source and target by looking at the “Account Mapping” CHIP. Additionally, if Central Payment is active in the target system, the “Clearing Status” CHIP will reflect the status of that document in the target system.

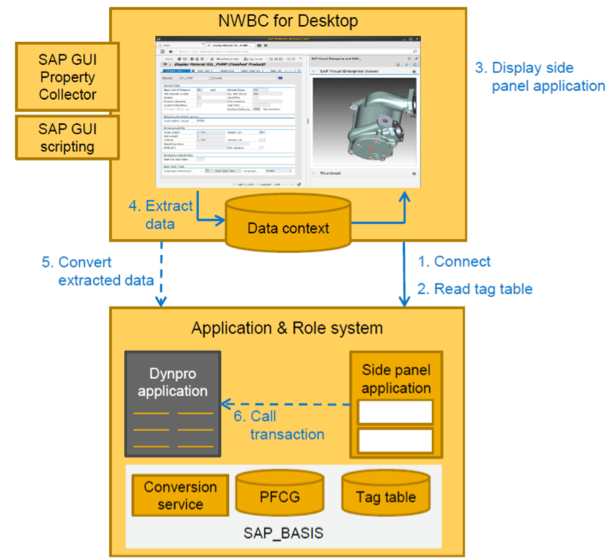

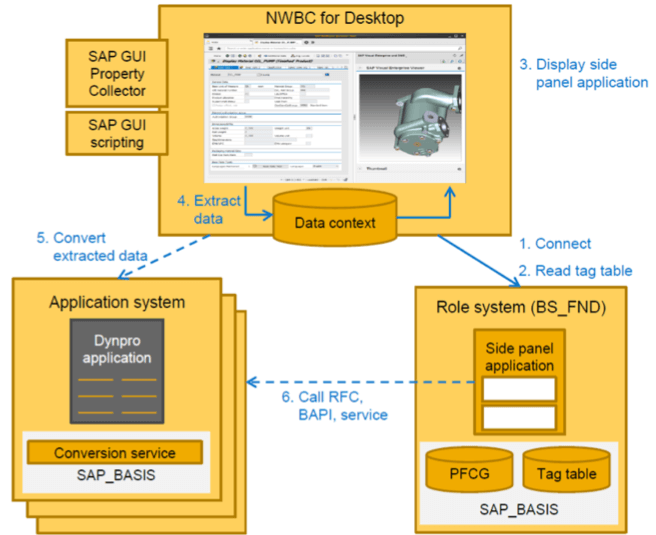

Side Panel Architecture

The architecture for Side Panels can be a bit convoluted when considering the usage of NWBC, RFC’s, security roles, source system(s), and Central Finance. Let’s briefly discuss the two architectural approaches that can be taken when setting up and deploying side panel functionality.

Figure 3 – One-system Side Panel architecture (2)

- One-system architecture in which the application and side panel content is all in one system. In this approach, the NWBC reads directly from the Central Finance system for the GUI transaction, RFC calls, and PFCG security roles. One note of importance is that regardless of the system you access the Side Panels from, they always run on the Central Finance system. Therefore, the RFC’s, which are configured in the Central Finance system, are used to pull data from both the source and target systems.

Figure 4 – Side-by-side Side Panel architecture (2)

2. A side-by-side architecture where the side panel application is running in a role system while the ERP application (Central Finance) is running on another system. In this approach, the NWBC reads from Central Finance and the Role system for the PFCG security roles. The main difference in this scenario is the GUI transactions and subsequent RFC calls are being executed in the role system and reading from the application system, whereas in scenario 1 both the GUI transactions and RFC calls are being executed in the same system.

Master Data and Other Use Cases

When implementing Central Finance, master data and master data mapping are always a huge topic of discussion. As you can see in Figure 5 below, the master data CHIP’s enable the end user to see any mappings between the source and target system for G/L’s, Customer, Vendor, and Cost Center. This is particularly critical when there are master data mappings in place, as the end user does not have to be in the target system to see the mappings. The master data mappings between source and target can be seen in near real-time all through the source system.

Figure 5 – Master Data CHIP’s

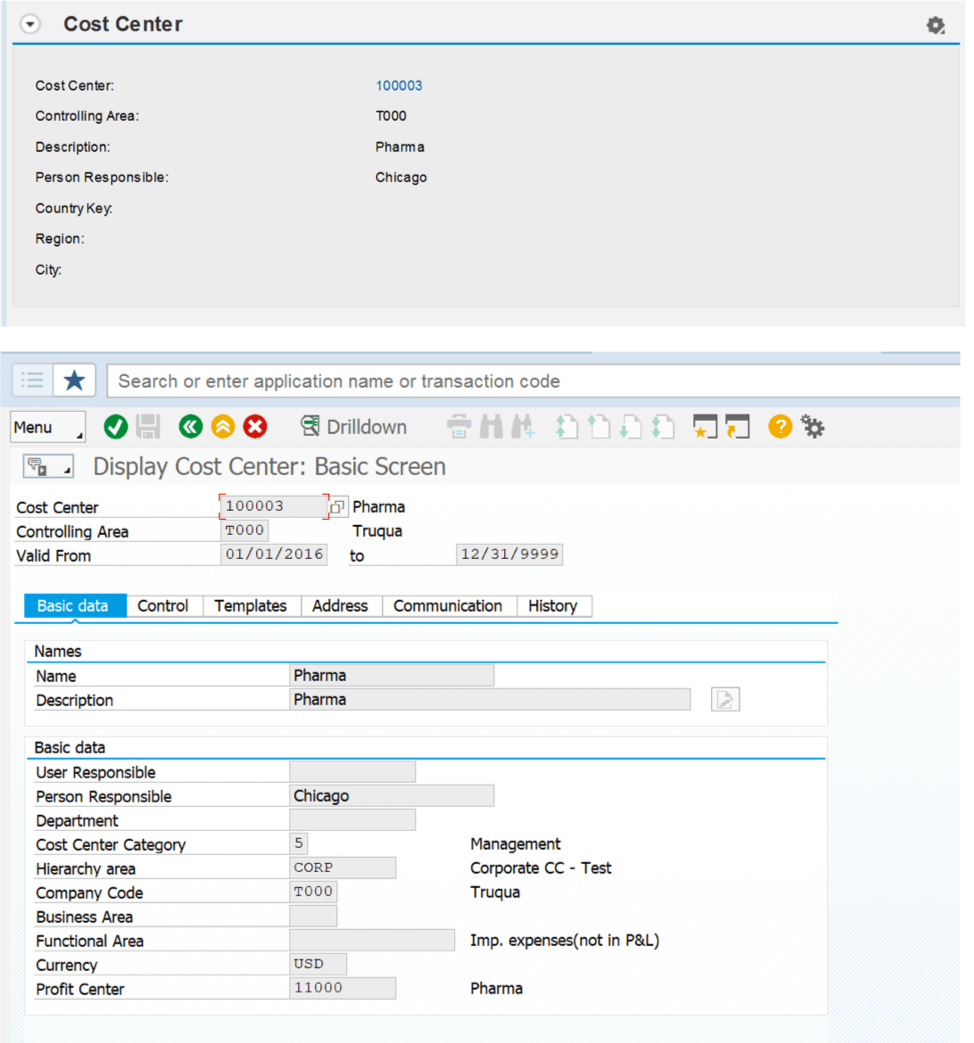

Additionally, the master data displayed via the CHIP’s will appear with a blue hyperlink allowing the end user to drill-down and display the master data record itself (Figure 6).

Figure 6 – Cost Center CHIP’s and Master Data Display

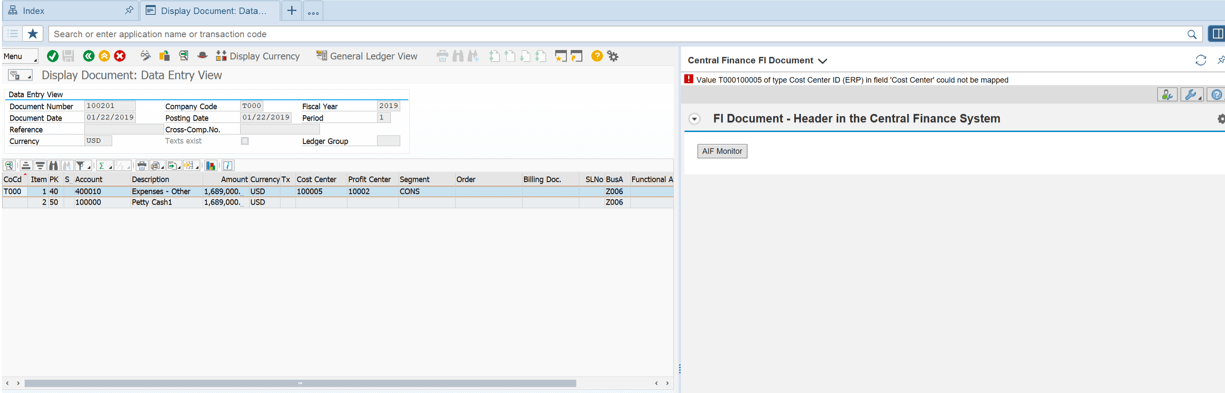

Side Panels can serve multiple purposes outside of document and data comparisons. When posting a document in the source system there is always a risk that the document will error out in Central Finance due to missing configuration or master data. In this instance, Side Panels are intuitive enough to include the Application Interface Framework (AIF) errors in the message area of the Side Panel (Figure 7). Additionally, there is a button in the header CHIP that will take the end user directly to the AIF to reprocess the document.

Figure 7 – AIF Cockpit via Source System Side Panel

As of S/4HANA 1809, the Side Panels can also be leveraged for displaying Sales and Distribution (SD) or Materials Management (MM) documents. By displaying the SD invoice in VF03 or the MM invoice in MIR4, their corresponding FI documents and clearing status in the Central Finance system can be displayed. As mentioned earlier, these Side Panels can also be accessed via the Central Finance system, thereby enabling the various business units to analyze the source system data from within S/4HANA.

Conclusion

The side panel functionality provides immediate value to the end users by linking and displaying source and target documents side by side. The side by side display provides the end user with immediate visibility and transparency into the data without the hassle of flipping screens or logging on to multiple systems. Additionally, the side panels equip the end user with traceability and auditability of the master/transactional data being replicated to Central Finance. In this era of financial transformation, Side Panels are another value-driven functionality that can be leveraged by consultants and end users alike.

For more information on the functionality within Central Finance or an exploratory call on what an implementation would look like within your organization, contact us today at info@truqua.com or simply fill out our form below.

Sources